Month: January 2010

I read a fascinating book yesterday called The Lights in the Tunnel: Automation, Accelerating Technology and the Economy of the Future by Martin Ford. I can’t remember who sent it to me (someone did – thank you); it appeared on the of my infinite pile of books so I gobbled it down as my first book at 2010.

The first half of the book sets up the situation and the corresponding problems. I agreed with much of the first half. The second half proposes a solution. I had a hugely difficult time with it. Ford anticipated this as he regularly acknowledged (unnecessarily) throughout the second half that many people would have a hard time with his proposed solution. Yet he marched on relentlessly.

Ford’s basic premise is as follows:

“At some point in the future – it might be many years or decades from now – machines will be able to do the jobs of a large percentage of the ‘average’ people in our population, and these people will not be able to find new jobs.”

Ford does a good job of spending the first half of this book making the case for this. He draws nicely from the notion of a technological singularity (which many of us are now calling simple “the singularity” for convenience), explains why mainstream economists (and the notion of econometrics in general) are basically historians rather than effective predictors of the future, does a nice job weaving the Luddite Fallacy into the mix, makes a compelling argument about China’s role in this he calls the “China Fallacy”, and wraps it up by revisiting a variety of conventional views of the future while asking “do we really believe they are going to play out this way?” (answer = no).

At this point I took a break and went for a walk around the block with my dogs. I knew the book was shifting from “problem” to “solution” (the next chapter was titled Transition) and I wanted to clear my mind so I could absorb it. I had a couple of weak ideas about where Ford was going to go, but it was pretty fuzzy to me. So I dove back in.

The second half of the book blew me away. Ford starts by asserting underlying his mental model – that in the future 75% unemployment will permanently exist because jobs will have been automated away – and they will not be replaceable. So – the vast majority of people in our society will be “unemployable” in a conventional sense (as in a 40 hour / week job). Ford asks rhetorically “Is it possible to have a prosperous economy and a civil society in such a scenario?” (answer = yes and he’s going to propose a way to do it.)

The base on which he builds his solution is the following idea:

“We will have to undergo a quantum shift in our value system. In order to preserve the free market system, we will have to come to the realization that while work (at least for most people) may no longer be essential, broad-based consumption is essential.”

He then spends the balance of the book explaining a government-driven taxation and incentive approach that taxes companies based on their permanently lost wages (based on automation, which he asserts will increase gross margins) while incenting the unemployed to act in ways that benefit themselves and societies by paying them based on how they act and contribute in this “non-traditional job” way. Ford suggests several simple categories, including Education (self and others), Community and Civic Activities, Journalism, and the Environment. He then spends a lot of time explaining the implementation at a high level, including an abstract example of how a functioning free-market society could exist post the singularity.

Sometime during reading this stuff my brain exploded and I had to go take the dogs for another walk. When I came back, I tried to explain this to Amy but couldn’t. I tried to make the argument that all government employees (local, state, and federal) are already in this category so the jump from the federally reported 10% unemployment to 75% isn’t as big as we might think since 8% already work for the government (so let’s say the jump is from 20% to 75%). I couldn’t do it – I just couldn’t take myself seriously.

While I love Ford’s tenacity with the idea and radical approach, I think this book would have worked better as science fiction rather than an attempt at an economic / political essay. Ironically, I might have been able to buy the argument better in the context of science fiction; when put against the backdrop of our existing social / societal construct, it was too difficult for me to absorb.

I have a belief that the structure of what we call “modern society” will have to change post singularity. I don’t yet have my own hypothesis for what this looks like, but many of my favorite science fiction writers have been hacking away at this for several decades. And I’m continuing to slurp down as much stuff as I can about the singularity since I both (a) believe it will happen in my lifetime – assuming I live a normal life expectancy and (b) I hope I’ll be involved in helping create it.

I’ll be following Ford’s blogging at his site econfuture: Future Economics and Technology. Even though I struggled with his solution, it’s another interesting input for me to ponder. And all of this also led me (via an article titled Martin Ford Asks: Will Automation Lead to Economic Collapse?) to a fun new website called Singularity Hub which has now been added to my feedreader. Now, time for some more Philip K. Dick.

Every quarter, without fail, a bunch of articles appear talking about the venture capital industries investment pace as a result of the PWC MoneyTree report. I used to get calls from all of the Denver / Boulder area reporters about my thoughts on these – that eventually stopped when I started responding “who gives a fuck?”

A few days ago I got a note from Steve Murchie about his new blog titled Angels and Pinheads. I’m glad Steve is blogging about this as he’s got plenty of experience and thoughts around the dynamics of angel investors – some that I agree with and some that I don’t. Regardless, my view is that there more there is out there, the better, as long as people engage in the conversation.

In his post Mind the Gap he made an assertion that “the VC industry has effectively stopped investing in seed stage ($500K and less) and startup-stage ($2M and less) opportunities.” As a VC who makes lots of investments between $250k and $2M, and who has plenty of good friends who happen to be VCs that also make investments in this range (such as Union Square Ventures, First Round Capital, True Ventures, SoftTech VC, FB Founders, Alsop Louis, O’Reilly Alpha Tech, and Highway 12), I thought Steve’s assertion was wrong and I told him so in the comments. He countered with the PWC Moneytree data on Q3 VC investments.

| Stage | Total $M | % of Total | # Deals | Avg / Deal $M |

| Later Stage | 1611 | 33.49 | 168 | 9.6 |

| Expansion | 1610 | 33.48 | 185 | 8.7 |

| Early Stage | 1081 | 22.49 | 198 | 5.5 |

| Startup/Seed | 507 | 10.54 | 86 | 5.9 |

Steve’s response to the Startup/Seed “Average Deal Size” was “WTF??!” While that is the correct reaction, his conclusion (that VCs aren’t investing between $250k and $2M) is incorrect for two simple reasons: (1) the data is the PWC MoneyTree Report is incorrect and incomplete and (2) the interesting number to look at, assuming the data is correct, is the Median, not the Average. If you wonder why, Wikipedia’s explanation is pretty good: “The median can be used as a measure of location when a distribution is skewed, when end values are not known, or when one requires reduced importance to be attached to outliers, e.g. because they may be measurement errors.”

Let’s look at the underlying data in Silicon Valley (that results in the above table) to understand this better. Going to the PWC Moneytree Startup/Seed investments in Silicon Valley for Q309, you get the following:

The first six “startup/seed” investments each raised $10M or more. Now, I’ll accept that these might be classified as “startup rounds” (e.g. the first round of investment) but no rational person would categories these as seed investments. But, for purposes of this example, let’s keep them in the mix. The average is $6.4M and the median is $5.0M. Now, let’s toss out only the ones $10M or great since these clearly aren’t “seed” investments. Our average is now $3.4M and the median is now $2.0M.

I’m still feeling generous (e.g. I’ll waive reason #1 – that the data is incorrect / incomplete – for the time being). Let’s look at the PWC Moneytree Startup/Seed investments in New England for Q309.

The average is $8.4M and the median is $5M. Now, toss out everything above $10M. The average is now $3.9M and the median is $4M.

But it gets better. Let’s take all of the PCW Moneytree Startup/Seed Investments in the US for Q309. There are 86 of them and as we know from the first table the average is $5.9M. But the median is $4M. Now, toss out the ones above $10M. The average is now $4M and the median is now $3M. This exercise – again – assuming the data is correct – shows the difference between average and median, as well as how much the numbers are skewed upward by “startup/seed” investments $10m or more.

I’m not going to try very hard to show that that the data is incorrect, but I’ll give you two examples. The first is FourSquare, a well known seed investment led by Union Square Ventures and O’Reilly AlphaTech. It was a $1.35M financing, has three employees, and occurred in 9/09. This is about as close to the definition of a seed investment as you can get. Yet, PWC Classifies it as Early Stage (plus they got the investment amount wrong as they list it as $1.15M.) For reference, Dow Jones VentureSource classifies this as a seed investment and gets the amount right.

Let’s do another one. This time look at what PWC MoneyTree has on First Round Capital

compared to what Crunchbase has on First Round Capital for Q309.

The differences that I think are incorrect on PWC’s part are that (1) GumGum is missing, (2) CoTweet is classified as Early Stage instead of Seed, (3) BigDeal is missing, (4) DNAnexus is missing (although it looks like it might have happened in Q2 even though it was widely reported in August), (5) Continuity Engine is classified as Early Stage instead of Seed, (6) ClickEquations is missing, (7) Sofa Labs shows up twice, and (8) Sofa Labs is classified as Early Stage instead of Seed. Now Crunchbase is missing Project Fair Bid (even though they reported on it) so they aren’t perfect, but at the minimum the misclassification between Seed and Early Stage is dramatic. Just for grins I looked these up in Dow Jones VentureSource and their data is closer to CrunchBase’s (especially the Round Type), but there are still differences.

Ever since I started investing in 1994 I’ve heard people spouting VC investment statistics to justify different viewpoints. I’ve always felt this was a “garbage in / garbage out” phenomenon. While there are some academics that do rigorous work around this (and understand the difference in importance between averages, medians, and er – statistically significant results), they are few and far between. And – most of the data people actually use and discuss is stuff like the PWC Moneytree Report.

I keep fantasizing that this madness will stop, but I doubt it will. In the mean time, I think I’ll go for an average run at a median pace.

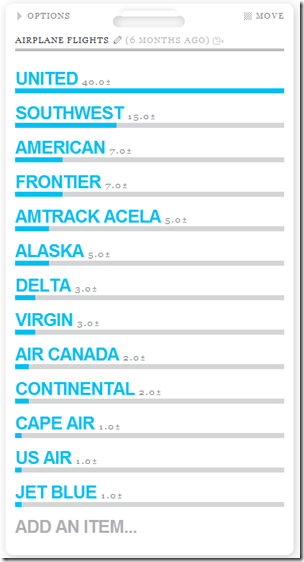

Last year I did an obsessive experiment. Every morning, as one of the tabs in my browser (then Firefox, now Chrome) during my daily information routine, I opened up a clever application called Daytum. In it, I tracked four things: the number of miles I ran, the number of books I read, the number of segments I flew on which airline, and where I slept. Following is the summary and some commentary.

I had a disappointing running year. I usually cover over 1,000 miles / year. I lost about four months this year to either injuries (silly ones) or a cold (I had a multi-month bacterial infection that took a while to figure out and nail.) Also, I didn’t run any marathons which, while a bummer, was something I expected would happen sometime on my question for 50 marathons by the time I’m 50 years old. So – 2009 will be known henceforth as “the lost year for Feld Running.” My goal in 2010 is six marathons and 1500 miles. And I’ll be tracking it obsessively with other software.

I typically read one or two books a week so 78 seems about the amount for a typical year. I always find the categories interesting – I read less SciFi this year than normal (I’d expect it to be on par with Mental Floss). The business books read are higher because I’m getting so many in the mail as “pre-release” or “review” copies so I’m trying to at least read some of them. No different goals for 2010 – just “read what’s in front of me that looks interesting from my infinite pile of books.”

Airplane travel in 2009 was totally fubared. I eventually decided to try to stop flying United and shift as much travel as I could to Southwest. I expect the ratios to be very different in 2010. I also took way too many short trips in 2009 and have decided to completely change my travel rhythm in 2010. Specifically, I’m only going to travel every other week – my goal in 2010 is to spend every other week in Boulder. Now, I know there will be exceptions, but I’ve already scheduled out my weeks in Boulder for the year so all I have to do now is be disciplined about scheduling.

I was fascinated to see the distribution of “where I slept in 2009.” I expected Eldorado Springs (my main house) to be at the top, but I also expected Keystone (my mountain house) to be ahead of Boulder (my city condo). The business travel is as expected – San Francisco, Boston, New York, Seattle, and LA. Vacations and weeks off the grid were San Diego (tennis), Mexico and Nassau (beach), and Santa Fe. The balance are short trips for specific things. The one think that I will not do in 2010 is “30,000 Feet” – I’m completely done with redeyes. And – no Alaska in 2009 – I expect I’ll spend 31 days there in 2010.

In 2010, I’m going to track an entirely different set of data – namely, all of my health and fitness data as part of my exploration around the idea of “human instrumentation.” I’m currently using a Zeo, Withings Scale, BodyMedia BodyBug, a Fitbit, and a Garmin 305. Look for more on this soon. And – if you make a device that tracks anything about the human being, drop me a line – I’m interested in talking to you.