Month: October 2013

My day started out great. After getting up at 5, having a delightful run at 6, walking Brooks, and then hanging with Amy for four minutes, I got in my car and drove over to Rally Software for their Big 1% Give Back event.

My day started out great. After getting up at 5, having a delightful run at 6, walking Brooks, and then hanging with Amy for four minutes, I got in my car and drove over to Rally Software for their Big 1% Give Back event.

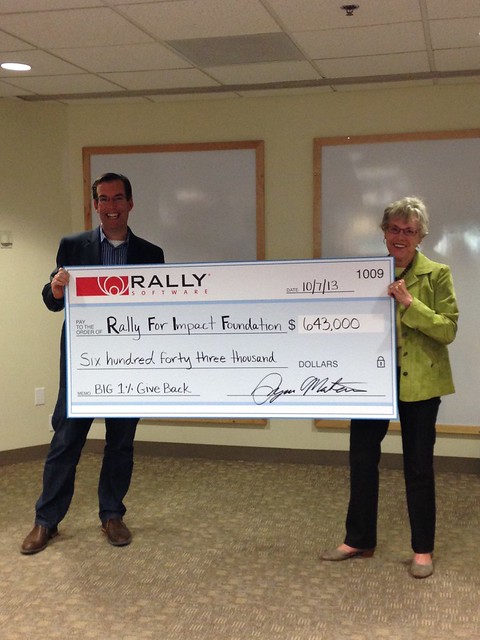

The picture to the left is of Ryan Martens, Rally’s founder and CTO, giving Josie Health, the CEO of The Community Foundation Serving Boulder County, a check for $676,000. This check is for The Community Foundation and for the Entrepreneurs Foundation of Colorado (EFCO) and results from a gift of 24,793 shares of common stock from Rally at the time of its first financing that represented approximately 1% of the equity of the company.

I remember numerous conversations with Ryan about this. Ryan started Rally (formerly F4) out of our previous office and could regularly be found scribbling all over a white board. He had a huge vision that started to be turned into practice when Tim Miller joined him as CEO about a year after he started the company. Part of that vision became the agile software development products that Rally makes.

But Ryan’s vision was always bigger than that. He wanted to build a sense of corporate social responsibility into Rally from day one. He was inspired by Salesforce.com and the Salesforce Foundation so he wanted to do something similar in Boulder – contributing 1% of the equity and 1% of the employees’ time to local philanthropic efforts.

With a handful of others, including my partner Seth Levine and Cooley’s Mike Platt, Ryan helped created the Entrepreneurs Foundation of Colorado. Rally was one of five founding members – the others were NewsGator, Collective Intellect, Me.dium, and Tendril. At the time, no one really knew how this would end up, but we all believed that it was important for the local startup community (which included companies anywhere in Colorado, not just Boulder) to give back to the community that helped support it.

We talked about creating millions of dollars of philanthropic contributions through the success of companies in Colorado over the next few decades. Some people rolled their eyes when we talked about this, some thought we were crazy, and some jumped on board. Throughout, Ryan’s leadership of EFCO was unbounded and today over 50 companies are members of EFCO.

Today’s gift represents the largest to date. Oh – that check is only for $676,000. Well the other one – for $643,000 – is the second check Josie got today – this one from an additional gift Rally made when they endowed the Rally for Impact Foundation.

Gang – well done. Thanks for leading by example. And we are only just beginning.

I saw Gravity on Friday night. I can’t remember being more immersed in a movie since I saw Star Wars 36 years ago. It could have been because I was wiped out from the week. It could have been the saki I had at the hibachi place before the movie. It could have been the Imax 3D stuff. Or it could have just been because it was an amazing movie.

If you haven’t seen the extended trailer, it’s worth five minutes of your life.

Now – this is a movie. It’s not scientifically perfect. But it’s so otherworldly that there isn’t much suspension of disbelief needed. And it only really has two actors – Sandra Bullock and George Clooney – and 95% of the focus of the movie is on them. Bullock has made her share of crap lately but she is incredible in this movie. Clooney was as expected. There was only one hokey scene that fortunately only lasted about three minutes. The music was excellent. And there were endless double entendres that jumped out at me including a perfect moment near the end for a Jaws reference that they gratefully omitted.

Imax 3D was a special bonus. I don’t do much 3D as I wear glasses and I find that the glasses on glasses action creates weird effects on the edges. But that didn’t matter in this case – the 3D action was so incredibly dramatic and powerful that the few times things got out of whack I just adjusted my glasses and everything was amazing again.

I will definitely be seeing Gravity again on the big screen. Wow. Space is a pretty cool place.

![HiRes_GFExNEXT_Logo_RGB-[2100x1828]-5_10 (1)](https://i0.wp.com/www.feld.com/wp-content/uploads/2013/10/HiRes_GFExNEXT_Logo_RGB-2100x1828-5_10-1-300x261.png?resize=300%2C261&ssl=1) I’ve been a big supporter of Startup Weekend, locally and nationally, since the very beginning and I’m continuing to do so by both sponsoring and mentoring in the NEXT Boulder program. NEXT by Startup Weekend is a wonderful next step for entrepreneurs looking for feedback on their idea or early business, while heavily leveraging the Lean methodology. Below are the words of Ken Hoff, an up-and-coming leader in the Boulder startup community. As the City Coordinator of the NEXT program, check out what he has to say about why he thinks the program is valuable. Ken can be found at @ken_hoff or thekenhoff@gmail.com. Following are Ken’s thoughts on NEXT Boulder.

I’ve been a big supporter of Startup Weekend, locally and nationally, since the very beginning and I’m continuing to do so by both sponsoring and mentoring in the NEXT Boulder program. NEXT by Startup Weekend is a wonderful next step for entrepreneurs looking for feedback on their idea or early business, while heavily leveraging the Lean methodology. Below are the words of Ken Hoff, an up-and-coming leader in the Boulder startup community. As the City Coordinator of the NEXT program, check out what he has to say about why he thinks the program is valuable. Ken can be found at @ken_hoff or thekenhoff@gmail.com. Following are Ken’s thoughts on NEXT Boulder.

NEXT Boulder is a 5-week pre-accelerator program, beginning on 10/15. Entrepreneurs will be immersed in the skills and tactics their startup needs and will get consistent advice and feedback from the best mentors in Boulder. Sign up here!

As a recent graduate of the Computer Science department at CU Boulder, I’m really lucky to have found what I want to do for the rest of my life, even if it was only recently. During my senior year, I took “Startup Essentials for Software Engineering” (taught by Zach Nies of Rally Software) and I can confidently say it was the best class I ever took at CU.

We learned how to take an idea and turn it into a company the right way using the Lean Startup process. We learned how to do customer development, conduct empathy interviews, and build a real MVP (not just an alpha version). We learned hands-on, functional, pragmatic skills for building a startup; not high-level theory or “how to write a business plan.” We got off the ground and out of the building right away.

Not everyone gets to have this experience – I was lucky to be a student at the time it was offered. For those of us who aren’t in school, you can try to do it all on you own, but you have to rely on the generosity of mentors to give you their time and their feedback. Accelerators and incubators can offer this, but they require you to have your business already in motion and are difficult to get into.

That’s why when NEXT decided to hold an event in Boulder, I jumped at the chance to help. I want to give entrepreneurs the same awesome resources I had as a student. NEXT can give aspiring entrepreneurs three major tools:

1. A cohesive, comprehensive curriculum on how to build your startup, with clear, pragmatic directions on what steps to take next.

2. The ability to work on your idea – something that you’re vested in and passionate about – and the confidence to take that idea to a competition or accelerator.

3. Copious advice and feedback about your company from the best mentors available, like Brad Feld, Nicole Glaros, Brad Bernthal, Robert Reich, and more!

NEXT Boulder runs from 10/15 to 11/12, and consists of weekly 3-hour sessions on Tuesday nights at the Silicon Flatirons Center in CU Law. Single founders can sign up, but co-founders are encouraged to attend together.

If you’d like to:

Attend NEXT, head over to NEXT Boulder to get your tickets, or contact me at boulder@swnext.co for more questions.

Sponsor NEXT, contact me at boulder@swnext.co for more information. It’s a great way to get your product or brand in front of lots of early-stage entrepreneurs and great mentors from Boulder.

Mentor for NEXT, contact me at boulder@swnext.co for more information. This is a great chance to give back to the Boulder startup community and see what the next generation of entrepreneurs has to offer!

A big thanks to Brad Feld for his generous donation, as well as Silicon Flatirons Center for the use of their space. NEXT provides entrepreneurs with the right combination of everything they need: skills, feedback, and the motivation to keep it going. I’m really looking forward to seeing a lot of great companies come out of the program!

I spend a lot of time hanging around CU Law School. I know it’s a strange place to find a venture capitalist and entrepreneurs, but it happens to be the epicenter of entrepreneurial activity at CU Boulder. I wrote a chapter about this in my book Startup Communities: Building an Entrepreneurial Ecosystem in Your City explaining why and how CU Law has taken a different approach to the engagement of the of a university and the entrepreneurial community.

I spend a lot of time hanging around CU Law School. I know it’s a strange place to find a venture capitalist and entrepreneurs, but it happens to be the epicenter of entrepreneurial activity at CU Boulder. I wrote a chapter about this in my book Startup Communities: Building an Entrepreneurial Ecosystem in Your City explaining why and how CU Law has taken a different approach to the engagement of the of a university and the entrepreneurial community.

Step back and think about it a little. A surprising number of entrepreneurs have legal backgrounds. A legal education is a great grounding in systems thinking, which can be applied to many businesses, especially as their scale up dramatically. And, in a world that needs less lawyers and more entrepreneurs, repurposing some of the brightest non-technical graduate students to be entrepreneurs is a neat idea. See – that’s not so strange.

Phil Weiser, the Dean of the CU Law School, is a good friend. Phil also totally groks entrepreneurship and is aggressively applying it to the vision, the curriculum, and the operations of CU Law. Following are some thoughts of his that recently appeared in an article in the ABA Journal titled Five initiatives that legal education needs.

Just like every other corner of the profession, legal education is grappling with a New Normal that was barely appreciated as recently as four or five years ago.

Even as law schools welcomed incoming classes this year, the mood has changed. And it’s no secret why.

Applications are down nationally for the third year in a row. And larger law firms aresignificantly cutting back on their entry-level hiring. The American Bar Association is also starting to focus on changes to legal education, recently releasing a draft report (PDF) from the Task Force on the Future of Legal Education.

Change is happening, and that’s a good thing.

The upside of today’s New Normal is that law schools have the opportunity to develop a new generation of lawyers who are more purposeful than ever before about how to develop and navigate their careers. These graduates will be legal entrepreneurs. By that, I mean lawyers—whether working in government, nonprofits, law firms, consulting firms, or businesses—who take ownership of their career paths and develop the tool kit necessary to add value and succeed wherever they work. Developing legal entrepreneurs, however, requires a commitment to innovation and experimentation that until recently has not been traditionally associated with legal academia.

To underscore the range of emerging innovations needed in legal academia, consider the following five initiatives now taking place in legal education:

1. Build an entrepreneurial mindset. Training law students to develop an entrepreneurial mindset is foundational for the New Normal. The reality is that large law firms are employing fewer and fewer law graduates, and the early interview week model is not what it once was. As such, law schools need to reorient their students’ thinking about their careers. An entrepreneurial mindset is a must in the New Normal, and law students need to heed LinkedIn co-founder Reid Hoffman’s teachings in The Start-up of You. How law schools will transmit those lessons to a notoriously risk-averse group remains to beseen. But the age of law school as a risk-free option for people who expect a job to be handed to them at the end is over.

2. Challenge employers on entry-level hiring. Challenging employers to think differently about entry-level hiring and summer jobs is a critical to adjusting to the New Normal. The marketplace for legal talent is incredibly traditional, and the resistance of employers to experiment is a formidable challenge to creating new opportunities for recent law school graduates. Most law students would welcome the chance to work at any number of successful law firms or in-house organizations in a temporary capacity over the summer or even upon graduation—even at lower rates than traditional summer associate or associate positions—because such jobs can offer valuable opportunities to build marketable skills and develop important networks, connections, and references. And such opportunities present firms with the chance to use the talents of these students or recent graduates. But a big impediment to developing such an opportunity is that firms often believe that they cannot provide them if they are not prepared to offer a long-term job when the student graduates. A number of law schools are taking this issue head on, such as the Cardozo New Resident Associate Mentor Program and, in Colorado, where both law schools (the University of Colorado and the University of Denver) are collaborating on a Legal Residency program that encourages law firms or other employers to hire a recent graduate for 12 to 18 months, offer a quality experience, and provide apprenticeship outside of the traditional associate track.

3. Compress law school education and couple with experience. Law schools can couple a 2.5 year degree with a quality experience. The opportunity to graduate in 2.5 years, which can be achieved through accelerated schedules that permit saving a semester, is increasingly appealing as tuition costs has risen greatly over the past decade. Law schools encouraging such paths can work with partners like Cisco’s general counsel Mark Chandler, who is welcoming paid interns for seven months at Cisco from June 1st after their second year until the following January, enabling students to graduate not only with less debt, but with more experience.

4. Provide multidisciplinary training. Law schools increasingly are providing their students with multidisciplinary training, including but not limited to key business skills. The New Normal means that “thinking like a lawyer” is not enough; we need lawyers who can “think like clients.” For lawyers to understand their clients, they need to learn their businesses. This concept applies to those working in the public sector as well as the private sector; lawyers with domain knowledge of the fields they are practicing in are simply more likely to succeed than those without such knowledge. This means more nontraditional courses, more interdisciplinary courses, and more “boot camp”-type experiences.

5. Engage with the community. Law schools need to engage with their communities, get to know their success stories, and reverse-engineer them. The reality is that law firm hiring is not coming back, and a core challenge for law schools is to develop nontraditional opportunities—such as ones in business development, compliance, human resources, and public policy—for law school graduates with the right skill sets. The challenge is that developing such partnerships and opportunities is a long game. But the forces that shaped today’s New Normal were a long time coming; the actions that will enable law schools to adapt will take time as well.

Experimentation, innovation, and the New Normal. In 2008, most law school deans were living in the Old Normal. Today, all law school deans know that they are in a New Normal. The reality is that the shaping of today’s environment took place over a long period of time, even if we did realize it while it was happening. As such, developing a new model will not happen overnight. But momentum is building. The broad outlines of the New Normal—the need for a more entrepreneurial mindset, more community engagement, more multidisciplinary training, and new (and nontraditional) employment pathways—are now taking shape through experiments all over the country. The exciting part of this emerging paradigm is that it is still very much a work in progress, and law schools have the opportunity to develop creative partnerships and innovations to support our students in a changing and challenging environment.

Two of the themes we love to invest in are Protocol and Glue. We’ve especially been interested in companies that make software developers and DevOps lives better. Some examples include SendGrid, Urban Airship, VictorOps, Pantheon, MongoLab, and Cloudability.

To that end, Raj Bhargava and I created a company called JumpCloud late last year (our eighth venture together). After being involved in hundreds of technology companies, we know that young and fast growing technology companies have little time to devote to the details of managing their server infrastructure. Often, there is a perception that things are fine, until they aren’t. And then much pain ensues.

My partners and I often worry about companies we’ve invested in having enough bandwidth and resources to adequately cover issues of reliability, availability, and security. We know firsthand what that entails, especially as companies hit high-growth inflection points.

Enter JumpCloud. JumpCloud helps DevOps and IT attain high levels of reliability, prevent unplanned downtime, and manage their environments like the big guys, without slowing them down. Watch David Campbell, one of JumpCloud’s other co-founders, explain JumpCloud at TechCrunch Disrupt.

JumpCloud is an agent-based SaaS tool designed for both cloud and physical Linux servers which provides full user management across all your users, all your servers, and all your clouds. JumpCloud also monitors your servers, identifies missing security patches, watches for attacks in progress, and identifies anomalous resource usage. JumpCloud is completely complementary to your Chef / Puppet / Opsworks configuration / automation tools. Think of JumpCloud as taking over server maintenance, management, monitoring, and security once the provisioning tools have done their thing.

JumpCloud closes the gap between what you can do and what you know you should be doing with regard to user management and security of your cloud infrastructure. That means fewer late-night calls, an easier to manage environment, and more reliability for your customers.

Sign up for free today, at JumpCloud, and let Raj and I know what you think.

Also, if you are a DevOps person or senior technical person in your organizations, Raj, Paul Ford from SoftLayer, and I are hosting a private DevOps Conference in Boulder on October 24th. While the event is for Foundry Group, Techstars, and Bullet Time Ventures portfolio companies, we have a few open slots in case a few folks would like to join us. Just reach out to me via email and I’ll get you connected.

This morning my partners at Foundry Group and I announced that we are going to make 50 seed investments of $50,000 each on AngelList between now and the end of 2014. We’ll be doing this via AngelList’s new Syndicate approach through an entity called FG Angel where we will create a syndicate of up to $500,000, allowing others to invest $450,000 alongside anything we do. For now, we are using my AngelList account (bfeld) which I’ve renamed Brad Feld (FG Angel). We are working with Naval and team at AngelList to get this set up correctly so that a firm (e.g. Foundry Group) can create the syndicate in the future, at which point we’ll move the activity over to there.

For years, we have had people ask if they can invest alongside us at Foundry Group at the seed level. We’ve never had an entrepreneurs fund, or a side fund, so we’ve encouraged people to invest in Techstars and other seed funds that we are investors in. As of today, we have a new way for people to invest alongside of us – via AngelList’s syndicate. The minimum investment is $1,000 per deal, so if you make a $1,000 commitment to our syndicate, you are committing to investing $50,000 alongside of us between now and the end of 2014 in the best seed investments we can find on AngelList. Simply go to Brad Feld (FG Angels) and click the big blue “Back” button. Special bonus hugs to anyone who backs FG Angels today (as I write this, the first backer has come in – from Paul Sethi – thanks Paul – awesome to be investing with you.)

This is an experiment. If you know us, we love to experiment with stuff, rather than theorize about things. We are huge believes in seed and early stage investing and through a variety of vehicles, including Techstars and our personal investments in other early stage VC funds, have well over 1,000 seed investments that are active. This has created an incredible network that adds to our Foundry Group portfolio. With FG Angel, we are taking this to another level as we begin a set of activities to amplify this network dramatically.

So there is no ambiguity, the investments come from our Foundry Group fund. All economics, including the syndicate carry, go to our fund. We are calling this FG Angel because we are approaching this the same way we do with any angel investment. I’ve written extensively about my own angel investing strategy in the past – you’ll see this reflected in what we are doing here. Over the years my angel strategy has been very successful financially and our goal with FG Angel mirrors that.

We expect we’ll learn a lot about this between now and the end of the year. When we learn, we’ll share what we learn. We believe deeply that the best way to learn about new stuff is to participate. So – off we go. We hope you join us – both in the syndicate and the ensuing network.