I expect we’ll be exploring, unscrambling, pontificating, and dealing with what is happening with GameStop (GME) for a while.

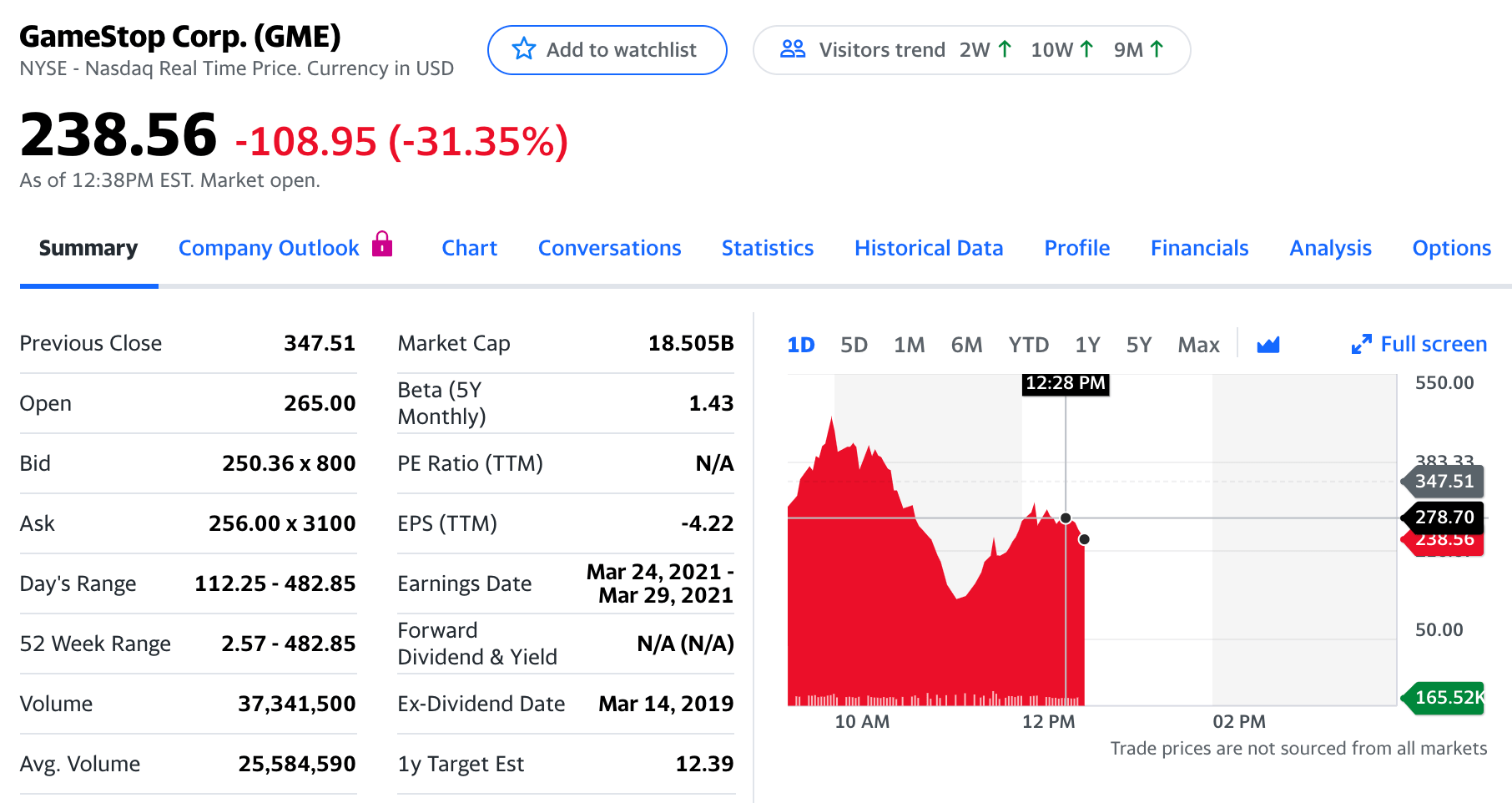

If you are reading this in the future and want some historical context for the rest of this post, this chart from the last 30 days of trading is instructive. At the end of 2020, we start at $20 / share.

30 days later, it’s at $238 / share with a high of $482 / share.

I’m not going to analyze this. I know what I think GME is worth, and it’s not $238 / share.

This morning, Fred Wilson wrote a post titled The Revenge Of Retail . It’s got a lot of good stuff in it, but plenty of things that are very different than what I’m actually thinking about today.

He ends with a recommendation.

What we need to do is stop printing money to stabilize the economy. And start addressing the real economic issues that exist on main street, not wall street. Monetary policy is not the answer. Fiscal policy is. That won’t stop more Game Stops from happening. They are a by-product of markets. But it will get the money to where it is needed versus where it is just gameplay.

I’m more interested in the 2nd, 3rd, and 4th order effects instead of the financial and market dynamics. For example, from Fred’s post.

The generational aspect of this is important. Boomer hedgies getting crushed by young folks self-organizing in social media. It feels like a moment where you realize that the power structure has shifted and things won’t be the same.

But hang on. Is that actually what is happening? Let’s go to something Fred says in his next paragraph.

The financial system in the US, and in other developed countries, is a rigged system and has been for a very long time. Only big institutions can get into hot IPOs. Only rich people can invest in startups. Many of these rules are designed to protect “widows and orphans” but all they really do is make the rich richer and keep those without money out of the game.

Rather than keep quoting Fred, I encourage you to go read The Revenge Of Retail post and then come back to the rest of what is on my mind this morning.

When I was an undergraduate in college (age 17 – 21; 1983-1987), I was interested in business and read three magazines: Forbes, Businessweek, and Fortune. I learned about the stock market by reading those magazines. That period was full of pump and dump schemes , especially on the pink sheets .

There have been periodic articles about the pump and dump activity in crypto . With the introduction of frictionless (e.g., free trading), a coordinated online crowd of millions of people, and low float stock (either highly shorted or not much supply in the first place), the setup for a classic pump and dump exists.

The regulatory environment has no capacity to keep up with something like this.

A combination of factors has created an environment where completely different behavior is possible. Today’s news is that it is happening in the financial markets. We may be talking about it here because we are now on the other side of 1/20/21; our prior President is no longer on Twitter and Facebook, so there’s a new sandbox to play in.

The dynamics are the same. Sentiment is manipulated. There have been endless discussions about this around politics over the past few years. Welcome to another part of our world (financial markets), where the unintended consequences of technology wreak havoc.

I expect we will see many more and many different examples emerge over the next few years. Governments trying to regulate it each time will be slow, and all will fail to do what they want to do while creating other unintended consequences.

We are living in a complex system. Technology has increased the velocity of change. It’s recursive, as the velocity of technology is changing faster than ever.

I have no idea what’s next. That’s the reality of a complex system. All I know is that it is going to get much wilder.

And, the best picture of the day is linked to a txt thread I’m on with Amy (we both love Capybaras) that includes the phrase “PhD in the madness of crowds.”

Minor change: I initially titled this “The Gamestop Phenomenon.” That’s a nice error on my part (freudian slip maybe)?