Category: Investments

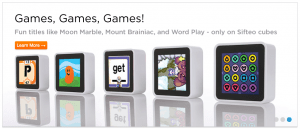

If you follow our investments, you know that one of our core themes is Human Computer Interaction. The premise behind this theme is that the way humans interact with computers 20 years from now will make the way we interact with them today look silly. We’ve made a number of investments in this area with recent ones including Fitbit, Sifteo, Orbotix, Occipital, and MakerBot.

Last week Bloomberg did a nice short piece on Sifteo. I’m always intrigued on how mainstream media presents new innovations like Sifteo in a five minute segment. It’s hard to get it right – there’s a mixture of documentary, interview, usage of the product, and explanation of why it matters, all crammed into a few minutes combined with some cuts of the company, founders, and some event (in this case a launch event.)

I find the Sifteo product – and the Sifteo founders – to be amazing. They have a lot of the same characteristics of the other founders of the companies in our HCI theme – incredibly smart, creative, and inventive technologists who are obsessed with a particular thing at the boundary of the interaction between humans and computers.

We know that these are risky investments – that’s why we make them. As we’ve already seen with companies like Oblong and Fitbit it’s possible to create a company based on an entirely new way of addressing an old problem, product, or experience with a radically different approach to the use, or introduction, of technology. Having played extensively with the beta version of the Sifteo product, I’m optimistic that they are on this path.

If this intrigues you, order a set of Sifteo Cubes today (it has just started shipping.) In the mean time, enjoy the video, and our effort to help fund the entrepreneurs who are trying to change the way humans and computers interact with each other.

Today one of our portfolio companies BigDoor announced the acquisition of San Francisco-based OneTrueFan, a community and web check-in company. We invested in BigDoor a little over a year ago and they’ve made amazing progress on their gamified loyalty platform since then. In addition to having over 300 live customers, BigDoor is also conducting a private beta of a truly innovative solution that they call the Engagement Economy, and we expect it have long lasting implications on how the digital world engages and monetizes their audiences.

Recently the market demand has been outpacing their ability to keep up, so they turned to OneTrueFan as a means of accelerating their product development and overall growth. When there is a great fit, I love seeing our portfolio companies make acquisitions. In this case, BigDoor gains access to a team of incredibly talented entrepreneurs (led OneTrueFan co-founders Eric Marcoullier and Todd Samson), thousands of publishers, and tech that fits perfectly into BigDoor’s gamified loyalty platform.

The former OneTrueFan team will be primarily focused on building and running a BigDoor branded rewards program that is targeted to long tail and medium size web publishers. When they launch BigDoor Rewards next month, it will carry with it many of the same characteristics publishers loved from OneTrueFan; brain-dead simple to implement, great analytics, increased content sharing, and far more user engagement. Shortly thereafter BigDoor will be taking the wraps off of their Engagement Economy private beta, and making it publicly available to larger publishers and online communities.

Todd and Eric have been friends of mine for a long time. Between the two of them they have co-founded IGN.com (IPO in 2000, acquired by NewsCorp in 2005), MyBlogLog (acquired by Yahoo in ’07) and Gnip (which I’m an investor in). Needless to say, I’m excited to see what happens as they join the BigDoor team.

Glassboard, a new mobile app for sharing privately with groups, just launched from my friends at Sepia Labs. They’re seeing some good initial coverage from ReadWriteWeb and Macworld and twitter is abuzz with people setting up private groups (which I find oddly amusing – but since there is no way to discover a “private board” – it makes sense.)

Glassboard highlights an interesting dynamic in the market that I’ve referenced before namely that collectively, as the creators and early adopters of technology, we still haven’t figured out the right balance of what information should be public and what should be private, and how this information should be used in the social graph.

Take location information as an example. One of the things Glassboard allows you to share with a group is your location, but they make it just as easy not to share it. You may recall that in March I had a foursquare checkin scare whereby someone tracked me down at a restaurant and called me on the phone to spook me because they knew my location. It worked – that interaction then led to me rethinking how I use my social graph – and, more specifically, how and with whom I share my location.

Location is one of those uniquely personal data points that, when used inappropriately, can leave you (or the people you care about) hugely vulnerable. And even though this vulnerability exists, your location is casually being used by advertisers to send you geo-ads and its being attached to all your photos. On one hand, its a great piece of data that can be really helpful when you need to tell people where you are or where you were, but on the other hand, the ways it can be used inappropriately are innumerable.

The Glassboard folks have recognized the sensitivity of location data and have implemented the strict end user controls over how, when and with whom to use it. They’ve also done a bunch of other interesting and important things in their group sharing app – I encourage you to check it out if you are on iPhone, Android, and Windows Mobile 7.

Vote For My SXSW Panel – An Inside Look at BigDoor’s Venture Funding

I’ve thrown my hat into the SXSW Panel Picker this year – please click here to upvote my panel titled An Inside Look at BigDoor’s Venture Funding.

I’ve never presented at a SXSW panel because I usually like to stay flexible and check out whatever’s interesting, but we came up with an idea that got me excited enough to commit. An Inside Look at BigDoor’s Venture Funding is going to be me, Keith Smith (BigDoor CEO), and Andy Sack (Lighter Capital, Founder’s Co-op, and the TechStars Seattle Managing Director). Both are good friends of mine and have really interesting philosophies about startup funding.

I think Keith was once quoted as saying “I’d rather give up my left nut than give up equity in my company” and having gotten to know him over the past couple years, I don’t think that’s far from the truth. Keith has over a decade of experience running startup companies and is extremely passionate about BigDoor, which made him aggressive in any discussions involving giving up a stake to both Founder’s Co-op and Foundry Group.

Andy’s a serial entrepreneur who has spent the past few years working on ways to make the funding process better for entrepreneurs. He led the first round of funding for BigDoor through Founder’s Co-op, but used a creative structure, partly because Keith is such a stickler on valuation. Andy and Keith will discuss this more on the panel, but they used a RevenueLoan approach to bridge the gap on price.

The RevenueLoan structure is something new Andy’s been working on at Lighter Capital, where instead of making an equity investment, they get a set percent of the company’s revenues over time. It’s a cool idea that worked out well for Andy and Keith, since it got Keith the funding he needed on terms that Andy was comfortable with.

As a side note, Lighter Capital is the leader in a new funding approach called revenue based finance which is an interesting alternative for entrepreneurs to fund growth in their small business. I may write about this more in the future, but in the meantime Lighter Capital is funding an “explosive” company in August (you’ve got two days left to apply), a fun idea to keep small business funding interesting and worth checking out if you need 100K to 500K right now.

During the panel, I plan to bring Keith and Andy water to support them, as is my typical role. I actually didn’t like Keith’s business when I first came across it but as we got to know each other he did an awesome job keeping me in the loop, listening to my feedback, and iterating, so after about six months, I came around especially to Keith but also to BigDoor’s business. I’ll be giving my thoughts on how Keith convinced me to invest by just running his company and interacting with me over an extended period of time rather than by pitching me.

If you are into this, upvote our panel. Either way, I’ll see you at SXSW.

Play golf? Just watch the video. Then go pre-order a Sphero.

Office Golf with Sphero the robotic ball from GoSphero on Vimeo.

If you want to see the app behind this, Orbotix has a longer description on their website.

Today we announced that we’ve led a $10m round for MakerBot Industries and I’ve joined the board. I’m super excited to be working with Bre Pettis, Adam Mayer, Zach Smith, and the rest of the MakerBot gang to create consumer-grade 3D printers.

When I first met Bre, Adam, and Zach at the Botcave in Brooklyn, it was love at first sight for me. The entry way to the BotCave has a series of Thing-O-Matics (the current MakerBot 3D printer) printing out all kinds of things. A display space of 3D things sits next to a vending machine with 3D parts in it, which all open up into a warehouse space full of tiny little parts neatly arranged and being put together in kits to be shipped. At the back were a bunch of people banging away on computers.

I took a deep breath and at that moment thought “I have to invest in this company.” I spent a few hours with Bre, Adam, and Zach and came away even more excited. I knew I had a massive nerd crush on them, but I also felt like if anyone was going to create a self-replicating machine that my father would buy, these were the guys. It’s well known by now that I believe the machines have already taken over – investing in MakerBot seems like another way to help them out.

Fortunately my partners loved the MakerBot gang as much as I did. But, rather than just theorize, I bought a MakerBot Thing-O-Matic and Jason, Ross, and I put it together. It’s been busy printing out all kinds of things for the past few months. The day we signed the term sheet, I made some Foundry Group coins (with the Foundry Group logo on the front and a $ on the back) and fedexed them to Bre. I wonder what he’ll make and send back to me now that we are investors.

I believe that we’ll look back in 20 years and 3D printers will be as ubiquitous as laser printers are today. We aren’t yet at the point that is equivalent to the first HP Laserjet in 1984, but I think we’ll see a comparable product from MakerBot within a year. In the mean time, I’m going to keep downloading 3D things from the Thingiverse and keeping my Thing-O-Matic busy.

For a limited time, Occipital’s Panorama 360 is free. If you don’t know why this is such an awesome app, watch the short video demonstration below.

We closed our investment in Occipital last week and I wrote about it in the post titled The World Is Just A Bunch Of Pixels. The Occipital gang is going to create a bunch of amazing stuff and now’s your chance to get on board with a one minute iPhone download. And, if you are reading this after the free offer expires, it’s still worth getting for the couple of bucks they are charging.

Mark Suster interviews Ian Rogers, the CEO of Topspin Media, on ThisWeekIn Venture Capital. We’ve been investors in Topspin since early 2008 and I’ve got a huge man crush on Ian. I find him incredibly passionate and articulate about what he does – he exemplifies the kind of entrepreneur we want to back in our Distribution theme. Oh – and Ian was the original webmaster for the Beastie Boys – how cool is that? And, in case you were wondering, the original Beastie Boys website was at https://www.cs.indiana.edu/~irogers/beastieboys.

Yesterday, we announced that we have invested in Occipital. You may know them as the creators of the popular iPhone app 360 Panorama, the creators of Red Laser (acquired by eBay), or just a gang of the smartest computer vision guys you’ll come across. And when I say “computer vision”, I don’t just mean the technical part, but also a vision of where it’s going. For example, from the Occipital blog post announcing the investment:

“Your smartphone’s computational reach into its surroundings ends at its touchscreen surface. To your device, the real world isn’t a canvas of interactivity. Instead, it’s little more than a grid of pixels that might as well be random. We’re changing that. We’re using computer vision to make real world environments computationally interactive and fun, thereby extending the computational reach of your device into the visual space around you.”

I met Jeff and Vikas in 2008. They are brilliant and have always had a huge vision. In Do More Faster, they wrote that you should Be Tiny Until You Shouldn’t Be. Red Laser was step 1. 360 Panorama was step 2. 360verse is step 3. And we are really psyched to invest and to help out with step 4.

Just for perspective, with my iPhone, I was able to create a pano of where I’m staying in Tuscany. It took 7 seconds and I’m a pretty mediocre photographer.

We now have three investments, starting with the letter O, in teams that just blow my mind with what they can make a computer do. We’ve talked about Oblong many times in the past. And our friends at Organic Motion just released an amazing new version of their markerless motion capture system.

Our good friend Manu Kumar from K9 Ventures joined the board as did Gary Bradski of Willow Garage.

Here’s to the letter O, as well as the machines getting a little bit smarter, every day, and in every way.