Tag: podcast

Tim Ferriss Podcast: The Art of Unplugging, Carving Your Own Path, and Riding the Entrepreneurial Rollercoaster

Tim Ferriss did one of his very long-form (150 minutes) podcast with me last week. I met Tim for the first time in 2007 and we’ve been friends since, although we’ve spent relatively little time together in person. Like many of my friends, I have a very comfortable remote relationship that has a lot of emotional intimacy in it. While many humans find this difficult, I never have and enjoy it a lot.

I think this comes through nicely in the podcast. It helps that Tim is particularly amazing at the long-form podcast interview. While the setup was around my new book, The Startup Community Way, which comes out tomorrow (please pre-order – authors love pre-orders), I don’t think we talked about the book at all until around hour two!

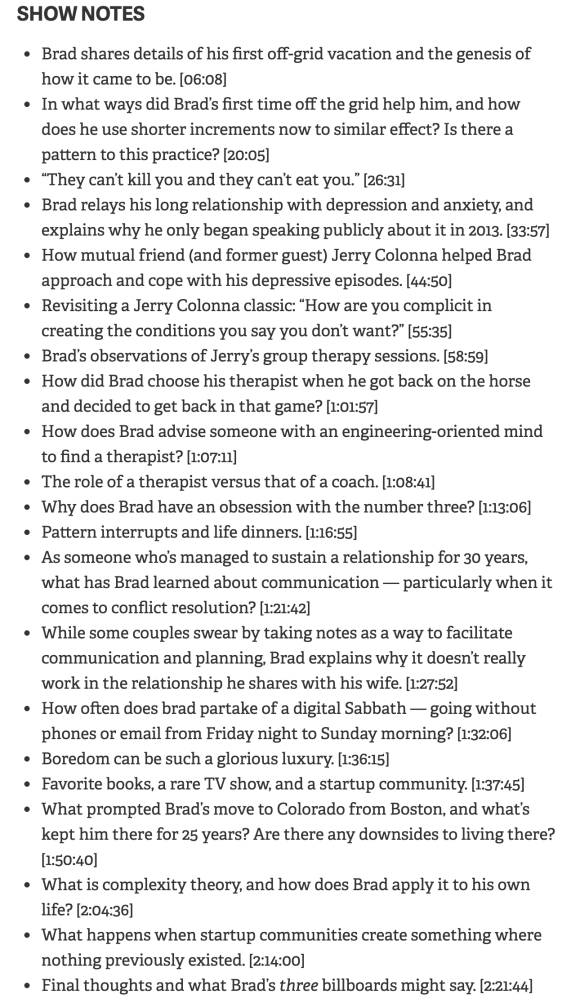

The following are the show notes. I hope you get a chance to listen to this. And, if you have any thoughts or feedback, drop me a note!

Tim – thanks for doing this. I’m honored to be part of your podcast cannon (#448!)

The phrase “contemporary mentors” popped into my head on loop number six of eight on my morning run. I’m training for a Covid marathon, which is 27 loops around my property.

My pace is tentative as I’m still gearing up after a long break due to a back injury, but I’m letting the miles and the time on my feet build on the weekends.

Running in circles for hours is different than running in the mountains in Aspen during the summer. But, I’m afraid of going to Aspen right now because of Covid, and I’m afraid of leaving my property and running on the roads or the trails near Boulder.

So, I’m embracing the circles. Amy likes it because she can keep an eye on me and let Cooper come out for the last couple of loops. While I think he could run with me forever, she worries about him when he goes for more than three loops, which is about six miles for him given all the back and forth he does.

I’ve decided that I’m going to approach the second half of 2020 differently than I approached the first half. This weekend, I turned off a bunch of inputs. I had several long conversations with Amy, right after I meditated, but before I did anything else, including one today where I acknowledged that the organizing principle I’ve been operating with for the last year isn’t working for me. I spent a lot of time outside, but without feeling tethered to anything. I allowed myself to feel what I was feeling, instead of trying to catch up or get on top of the stuff. I laughed at the few absurd things that crossed my path, rather than letting them aggravate me. I thought some more about what I wanted to spend my time on and what I was going to delete.

None of this is new for me – it’s a regular repeating cycle. Sometimes it’s part of my burnout loop or a boom-bust work cycle. Other times it’s a function of not knowing my limits and getting depressed. Once it was a function of a self-induced depressive episode because I stupidly took Ambien for two weeks on an international trip. And sometimes it’s just random.

A little more than a year ago, I came up with a new organizing principle for how I was going to address my work. I thought it was clever, was proud of myself for coming up with it, and tried it for a while. About a month ago I realized that it was a failure and that I wasn’t happy with it. While several aspect were working, several weren’t, but most importantly I realized that my frustration with it and my determination to try to make it work, even when it wasn’t, was making me unhappy.

So, about a month ago, I threw it away. I didn’t stop any of the activities I was doing, but I threw away the organizing principle.

This morning, I told Amy that I had thrown it away. It was the first time I was able to articulate this clearly. I don’t have a new organizing principle yet, but I knew the one I was using wasn’t working.

When my running loops increased, I realized I needed to listen to something while I’m running. Usually, I run “naked” (without headphones), especially when I’m in the mountains or on trails. But, after a few 0.95-mile loops, I want some stimuli other than “another loop.”

I decided to go through some Tim Ferriss podcasts and listen to some of my friends that he interviewed. I think the world of Tim and have learned a lot from him, even though we haven’t spent a lot of time together. And, whenever I listen to any of his podcasts, I learn at least one thing, and they often cause me to think about a few things.

In order, over the past few longer runs, I’ve listened to:

- Secretary Madeleine Albright — Optimism, the Future of the US, and 450-Pound Leg Presses (#437)

- Jerry Colonna — The Coach with the Spider Tattoo (#373)

- Ryan Holiday — How to Use Stoicism to Choose Alive Time Over Dead Time (#419)

- How Seth Godin Manages His Life — Rules, Principles, and Obsessions (#138)

- Jim Collins — A Rare Interview with a Reclusive Polymath (#361)

It was in the middle of Seth’s interview that the phrase “contemporary mentors” popped into my head.

I was searching in the background for a phrase different than “entrepreneurial heroes.” I started my first business in the 1980s and my entrepreneurs heroes include Bill Gates, Mitch Kapor, Steve Case, and Dan Bricklin.

But Seth, Jerry, Ryan, Tim, Madeleine, and Jim are in a different category. They are mentors of mine, in a long list of mentors. Some – like Jerry – are soulmates. Others, like Madeline and Jim, are people I know a little bit but respect enormously. And Ryan and Tim are contemporaries on a different vector entirely.

Aha – “contemporary mentors.” The ideal mentor-mentee relationship is when the mentor and mentee become peers and learn from each other. But peer mentorship has never become an easy category for me to explain as it implies an evolution from a mentor-mentee relationship. What if that’s not what happened.

Tim and Seth – thank you. As I listened to you today on my run, I learned from each of you, while having a close emotional connection from my own relationship with each of you. And from it came a new phrase for me: “contemporary mentors.”

I do a lot of random podcasts and especially like to be an early guest on new ones to help get them started.

001 – Brad Feld

The first five episodes are with me, David Cohen, Susan Conover, Amos Schwartzfarb, and Charlie O’Donnell.

Andrew Waine is the producer. He’s currently a senior at the University of Florida finishing his Bachelor’s degree in the Summer of 2020.

He reminds me of a young Harry Stebbings of the 20 Minute VC who reached out to me early (I was on Harry’s 65th episode in 2015), hustled, and did a fun interview with me where we cover the following topics.

- What is in the new edition of Venture Deals

- My time as an entrepreneur and entry into venture capital

- Advice from Jack Tankersley, an early mentor

- The differences between raising fund I vs. fund II at a VC Firm

- How fund sizes impact investing strategies

- How a startup can weather the storms of an economic downturn and the characteristics of the companies that survived the 2008 recession

- My opinion on USV founder Fred Wilson’s blog post about the importance of follow-on capital

- Why Foundry Group invests capital into other VC funds

- What startup accelerator Techstars looks for in its applicants

- Some resources and advice for a young person looking to gain knowledge about VC and Startups

You will even find out where I learned that “even pigs can fly in a hurricane” around minute six.

Amy and I driving to dinner with Ben Einstein and Grace Livingston a few months ago. Amy generally dislikes podcasts so she was annoyed with me as I fiddled with my iPhone and Carplay which kept opening my podcast app.

Ben said, “Have you listened to The Anthropocene Reviewed?”

I responded, “The what what?”

Amy said, “Put some music on.”

Ben tried again. “Put on The Anthropocene Reviewed Scratch ‘n’ Sniff Stickers and the Indianapolis 500.”

15 minutes later Amy said, “Not bad” and I was hooked.

Several of my favorites have been Notes App and Sports Rivalries, Hot Dog Eating Contest and Chemotherapy, Gray Aliens and Rock Paper Scissors, and Teddy Bears and Penalty Shootouts.

If you are looking for a new podcast, give The Anthropocene Reviewed a try.

When David and I started doing the #GiveFirst podcast, I was told by a long-time podcaster that it takes about 20 episodes to hit your stride. Since then, several other podcasters have told me that the number is actually closer to 100. Given that hurdle, David and I are 20% of the way there.

In Episode 22, we review the last dozen podcast guests including Josh Hix, Rajat Bhargava, Elizabeth Kraus, Jason Mendelson, Jannet Bannister, Heidi Roizen, Marc Nager & Dave Mayer, John China, Sherri Hammons, Rebecca Lovell, and Harry Stebbings.

I’m enjoying co-hosting the #GiveFirst podcast with David. I hope you are enjoying listening to it.

In 2010, David Cohen and I wrote a book titled Do More Faster. It was filled with stories and advice from founders, investors, and mentors from around the first two years of Techstars.

This was the first book I wrote. David and I learned the joy and pain of writing a book. We were lucky to get to work with Bill Falloon, who has been my long-time editor on all the books I’ve written. Bill guided us through the process and helped us understand what was required to put together a real book.

Last month we released Do More Faster, 2nd Edition. We’ve freshened it up with new content, some new stories, and updates on where everyone is from the first edition.

We just released an episode of the Give First podcast with some behind the scenes back and forth on the book. Enjoy the Give First Do More Faster podcast episode and go grab a copy of the new and improved 2nd Edition of Do More Faster.

Today’s Give First podcast features Harry Stebbings of the 20 Minute VC and a partner at Stride.vc on committing to building a network & giving first.

Harry is probably best known for his podcast, The Twenty Minute VC, the world’s largest media asset in venture capital, with over five million downloads per month. He’s talked with amazing VCs and entrepreneurs on over 2,800 shows.

When he was 13, Harry watched “The Social Network,” the movie about Facebook, and it inspired him to become an entrepreneur and investor. At 18, he set up the Twenty Minute VC podcast.

I was interviewed on Harry’s 65th episode in 2015. It was fun to travel back in time and listen to it. And, I love Harry’s Google Glass picture.

Harry is on episode 11 of the Give First podcast. We’ve made it to double digits which I’ve heard is a milestone for a lot of podcasts that stall out before that. Next step – triple digits. If you missed the last few along the way during my blogging vacation, they include John China (SVB), Sherri Hammons (The Nature Conservancy), and Rebecca Lovell (Create33).

I’m a huge fan of Elizabeth Kraus, Sue Heilbronner, and the work they do through MergeLane.

Recently Elizabeth started a platform for the next generation of venture capitalists called Fund81. It includes a podcast, which has both a public section for everyone and a private section for the Fund81 members.

Elizabeth recently interviewed me for Episode 13 where we talked about maintaining mental health in the fast-paced venture capital world while supporting portfolio companies, colleagues, friends, and family wrestling with mental health issues. The public section follows.

Elizabeth and Sue – thanks for everything you and the team at MergeLane do for entrepreneurs and now other VCs.

When I wrote the post Every Lie We Tell Incurs a Debt to the Truth I expected to get some feedback. I got more than I usually do (mostly by email vs. blog comments) and much of it was thoughtful.

One person pointed to the video I embedded, which I thought was great. It’s an extensive explanation of things in HBO’s Chernobyl that were either simply wrong or exaggerated. The video is entertaining as well as substantive, so it’s a good addition to the content from the show.

Separately, I listened to The Chernobyl Podcast on my drive up to Aspen about two weeks ago. If you watched the HBO Chernobyl docudrama, the accompanying podcast is a must listen. Peter Sagal (host of NPR’s “Wait Wait…Don’t Tell Me!) interviews Craig Mazin (Chernobyl Series Creator and Executive Producer.) Peter is an awesome host and he pulls out a ton of interesting, useful, and curious information from Craig.

Next up for me is reading Midnight in Chernobyl: The Untold Story of the World’s Greatest Nuclear Disaster which is near the top of my pile of infinite books to read (right after I finish Black Crouch’s Recursion.)