Tag: investments

We just announced our investment in Meru Health. If you recognize Meru Health, it’s because I wrote about it in January as part of my explanation of Freestyle’s Leadership on Mental Health. I highlighted what Josh Felser and his team at Freestyle were doing, which included underwriting 100% of the cost for two programs – Meru Health and Hoffman Institute, for all of their founders.

We got to know Kristian Ranta and his team at Meru Health through Josh. Freestyle is one of our 32 partner funds (where we are LPs) and most of our new direct investing activity is in conjunction with one of our partner funds.

Forbes wrote a detailed profile of the company and the investment in Foundry Group And Slack Are Backing A Virtual Therapy Startup That Raised $8.1 Million and we are excited to be part of Meru Health.

Over the past two months, I’ve been asked almost daily if “VCs are investing during the Covid crisis.” Generic questions like this are impossible to answer, as “VCs” are not a singular archetype (there are many types of VCs with different strategies, goals, personalities, and constraints.) So, I answer it from the frame of reference of what we are doing at Foundry Group.

In general, I think the best answers are examples.

For me, the Covid crisis started on March 11th. This was the first day I worked from home and haven’t left my house since then. We were planning to have our CEO Summit in Boulder on March 12th and 13th but cancelled it on March 9th. My parents were coming to Boulder on March 12th for a long weekend and to celebrate my dad’s 82nd birthday. My brother Daniel and I decided to cancel their trip and told them the night of March 11th. Bryan Leech at iBotta hosted the first “Denver Business Leaders” call the morning of March 11th. So, when I look back and mark this moment in history, it started for me on March 11th.

Since then, Foundry Group has closed three new investments.

- Fritz.Ai (partner fund: Uncork): March 25th

- Code Climate (partner fund: USV): May 11th

- Meru Health (partner fund: Freestyle): May 13th

We generally make about 10 new investments a year. While it’s not spaced out monthly (we don’t try to manage timing that granularly), if you look back to when we started Foundry Group in 2007 we’ve done a maximum of 14 new investments in a year and a minimum of 8 new investments.

When asked if we are investing, I answer “yes – on the same pace as we always have.” We have a deeply held belief that time diversity in investing matters, and the key is to keep the same pace of new investments no matter what is going on in the macro.

I passed on something referred to us by a close VC friend (who I’ll call Joe) who I’ve done a bunch of investments with over the years. A few minutes later I got the following email from the entrepreneur.

hey brad –

if you get a moment, i’d love to hear your unvarnished reasons for the denial. thanks for the time…- i remain a huge fan of your blog…….

I get asked regularly for feedback on why we pass on something, especially when we pass after a single email interaction. As with many things, it’s useful to start with your strategy, assuming you have one.

In Foundry Group’s case, our goal is not to invest in every great company, it’s to invest in ten potentially great companies a year.

As part of our strategy, we have purposely constrained our fund size ($225m per fund, which lasts about three years and covers about 30 investments) and our partnership size (four partners, no associates.) As a result, our goal is to say no in 60 seconds. Sure, we’ll miss some great opportunities, but that is fine as long as we believe (a) there are more than 10 great potential companies for us to invest in each year and (b) our deal flow dynamics are such that we see a lot more than the 10 we end up choosing to invest in.

Based on our current deal flow dynamics, if we had unlimited time, unlimited capital, and unlimited partner resources, there are at least 100 companies each year that we would invest in. This 100 number is not “deal flow” – this is actually investments that we’d make. So given our strategy constraint, we could miss investing in 90% of the things we wanted to invest in and still have enough new, great, potential investments to execute on our strategy.

Many of our quick passes are in the “it’s us, not you” category. There are a few things driving this. Following is the response I sent to the entrepreneur above in response to his question about why I passed.

1. Stage – this is later than our usual entry point. If you’ve raised more than $3m, we generally don’t engage. We don’t have to be the first money in, and we love to work with Joe, so I squinted and made an exception since you’d only raised $4m

2. Focus – We are very selective since we only do 10 new investments a year. I wrote a post about this a while ago (https://feld.com/archives/2009/06/say-no-in-less-than-60-seconds.html). I took the first meeting / call because of Joe. I tested high level response internally against the other 100 things that are in front of us. It was no where near the top (we have this discussion continually and use each other for reactions).

3. Engagement – I’m in Dubai next week and then Canada the week after that. Then I’m home for a week, in Cleveland, then in Boston/NY. So the next month is one of those months where nothing much new is going to happen on my end. We hate to play the slow roll game with entrepreneurs – one of our deeply held beliefs is to either engage or not engage quickly. Given #2 and then considering #3, I know that nothing is going to happen for a while and I have no interest in being the schmuck that just hangs around waiting to see if something happens.

Fundamentally, the quick positive reaction was “neat + Joe is awesome” then weighed down by 1, 2, and 3 above, resulting in “I’ll face reality quickly on this – we aren’t going to get there on it…”

While at some level this might not be satisfying to the entrepreneur, and I’ve had many challenge me to go deeper in my exploration of their company, given 20 years of investing it’s usually pretty clear when something is not going to happen. The reasons vary greatly, but having a strategy that causes it not to matter in the long run has been something that we’ve spent many hours talking about and making sure we understand.

Ultimately, understanding what we do, how we do it, and the strategy behind it is key to us being able to run Foundry Group with just the four of us. I take inspiration from a lot of people on this front, including Warren Buffett and his approach to his headquarters team for what is now one of the largest businesses on the planet.

There are clearly more than one way to run a successful VC firm – our goal is to run it the way we think we can be successful at it.

Yesterday, at The Calloway Way event at MIT, I ran into Joe Caruso. I’ve known Joe for a while – we met through Techstars Boston, where he’s been a great mentor and very active angel investor.

He had just read my post on being uncomfortable with the phase of the current cycle and told me an anecdote from the great Internet bubble of 2001 that I hadn’t heard.

A guy came up to me and said “I just sold my dog for $12 million.”

I responded, “WTF – who would ever buy a dog for $12 million? That dog must have gold plated teeth!”

The guy responded, “Nope – but it’s a normal dog. But I was able to get two $6 million cats for it.”

When I got back to my room last night, I noticed Fred Wilson’s post from yesterday Averaging In And Averaging Out. In it, he talks about how he handles public company stocks that he ends up with either via an IPO or a sale of a company he’s involved in to a public company. We have somewhat different strategies, but we each have a strategy, which is key.

This morning I woke up to an email thread from a founder of a company I’m an investor in. He’d gotten a random note asking about his valuation when we invested relative to another financing that was just announced. When we made our investment, the company got about 3.5x ARR. The other company, which was much smaller at the point of investment, got an 11x ARR valuation.

My response to the specific situation was:

Valuations have increased on a relative basis.

They raised relatively little so probably had supply / demand on their side – which drove competition and enabled a higher price.

VCs are currently living in FOMO land so they’ll overpay for aspirational value in the future if they see growth.

There’s a lot of inefficiencies at these price levels.

A “good price” is when you have a willing buyer and a willing seller, both happy, and willing to work together on whatever path you are on!

Each of these examples got me thinking about the relative valuation trap.

In the first case, we’ve got a dog and two cats. Who knows what they are worth – you can get a dog for free at the pound and as far as I can tell cats believe they belong to themselves and do whatever they want. But trading one dog for two cats, where the person owning the cats values them at $6 million each, means you can “mark your dog to market” which is currently $12 million. Now, if you can find someone to give you $12 million in cash for the dog, you have a $12 million dog. But you can carry it at a value of $12 million for as long as you want if you don’t want to sell it. Granted Rule 157 says that you need to mark it to market every quarter, but that’s a different messed up issue.

In Fred’s example, he does a great job distinguishing between optimizing and satisficing. Two weeks ago Twitter stock hit $54 / share. Today it is trading at $42 / share. Should you have sold it at $54? How about $52? How about $49? Or, now that it’s fallen to $42, maybe it’s time to sell it at $42. If you have it at $42 and believe you should hold it because it was recently worth $54, you are falling into the relative value trap. You should hold it because you think it will be worth more, but not because it was recently worth $54. It could be worth more or it could be worth less – making your decision on what it used to be relative to what it is today is a trap.

In the financing discussion, it’s easy to look back in time and say “wow – we got too low a valuation.” It’s just as easy to look at valuation in current terms and say “that’s not high enough” because you heard of someone else, relative to you, that got a higher valuation. Or it’s easy to feel smug because you got a higher valuation than someone. Unless we are talking about the final exit of the company for cash or public company stock that is fully tradable, this is a trap. It’s like the $6 million cat and the $12 million dog. How did someone come up with the valuation?

A simple answer is “well – public SaaS companies are currently trading at 6x average multiples so we should get a 6x ARR valuation.” There are so many things wrong with this statement (including what’s the median valuation, how do it index against growth rates or market segment?, what is your liquidity discount for being able to trade in and out of the stock), but the really interesting dynamic is the relative value trap. What happens when public SaaS companies go up to an 8x average valuation? Or what happens when they go down to a 3x valuation? And, is multiple of revenue really the correct long term metric?

As I said in my email this morning, A “good price” is when you have a willing buyer and a willing seller, both happy, and willing to work together on whatever path you are on! I deeply believe this – my goal is not to get the best price, but a fair price. I don’t subscribe to the philosophy that both parties should feel slightly bad about the terms of the deal, meaning that each had to compromise on things they didn’t want to in order to get the deal done. Instead I’m a deep believer that both parties should feel great about the deal – the terms, the participants, and the dynamics.

Ultimately, whatever stage you are in, you should be focusing on building long term value. It’s always a mistake to optimize for the short term, and when you do, you’ll often confuse relative value as justification for specific behavior.

My day started out great. After getting up at 5, having a delightful run at 6, walking Brooks, and then hanging with Amy for four minutes, I got in my car and drove over to Rally Software for their Big 1% Give Back event.

My day started out great. After getting up at 5, having a delightful run at 6, walking Brooks, and then hanging with Amy for four minutes, I got in my car and drove over to Rally Software for their Big 1% Give Back event.

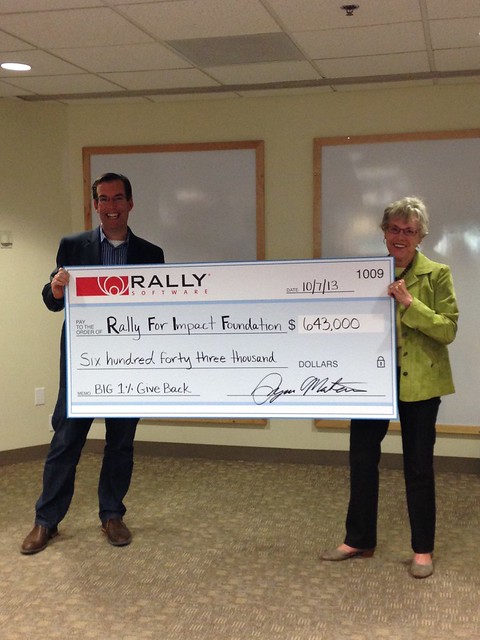

The picture to the left is of Ryan Martens, Rally’s founder and CTO, giving Josie Health, the CEO of The Community Foundation Serving Boulder County, a check for $676,000. This check is for The Community Foundation and for the Entrepreneurs Foundation of Colorado (EFCO) and results from a gift of 24,793 shares of common stock from Rally at the time of its first financing that represented approximately 1% of the equity of the company.

I remember numerous conversations with Ryan about this. Ryan started Rally (formerly F4) out of our previous office and could regularly be found scribbling all over a white board. He had a huge vision that started to be turned into practice when Tim Miller joined him as CEO about a year after he started the company. Part of that vision became the agile software development products that Rally makes.

But Ryan’s vision was always bigger than that. He wanted to build a sense of corporate social responsibility into Rally from day one. He was inspired by Salesforce.com and the Salesforce Foundation so he wanted to do something similar in Boulder – contributing 1% of the equity and 1% of the employees’ time to local philanthropic efforts.

With a handful of others, including my partner Seth Levine and Cooley’s Mike Platt, Ryan helped created the Entrepreneurs Foundation of Colorado. Rally was one of five founding members – the others were NewsGator, Collective Intellect, Me.dium, and Tendril. At the time, no one really knew how this would end up, but we all believed that it was important for the local startup community (which included companies anywhere in Colorado, not just Boulder) to give back to the community that helped support it.

We talked about creating millions of dollars of philanthropic contributions through the success of companies in Colorado over the next few decades. Some people rolled their eyes when we talked about this, some thought we were crazy, and some jumped on board. Throughout, Ryan’s leadership of EFCO was unbounded and today over 50 companies are members of EFCO.

Today’s gift represents the largest to date. Oh – that check is only for $676,000. Well the other one – for $643,000 – is the second check Josie got today – this one from an additional gift Rally made when they endowed the Rally for Impact Foundation.

Gang – well done. Thanks for leading by example. And we are only just beginning.

Today, TechStars announced that they’ve raised $24 million from a broad syndicate of investors to fund an additional $100,000 for every TechStars company going forward. The investors include Foundry Group, IA Ventures, Avalon Ventures, DFJ Mercury, SoftBank Capital, SVB Financial Group, RRE Ventures, Right Side Capital Management and TechStars alumni.

Today, TechStars announced that they’ve raised $24 million from a broad syndicate of investors to fund an additional $100,000 for every TechStars company going forward. The investors include Foundry Group, IA Ventures, Avalon Ventures, DFJ Mercury, SoftBank Capital, SVB Financial Group, RRE Ventures, Right Side Capital Management and TechStars alumni.

There are lots of good articles on the news – two of them are at TechCrunch (Startup Incubator TechStars Raises $24M, Increases Funding For Each Company By $100K) and Launch (TechStars Offering Extra $100K to All Companies with New $24M Fund.)

One of the principles of TechStars has been to be as inclusive as possible for the VC and angel investors in the communities in which we run programs. To date, there are over 75 VCs and angels that are funding TechStars programs in Boulder, Boston, Seattle, and New York. There are many more who have invested in individual TechStars companies.

With the launch of the new TechStars Cloud program, there are now over 60 new companies a year going through TechStars and getting launched. At $100k / company, TechStars has raised enough to fund each company with the incremental $100k for the next three to four years (that’s a hint that there will be more programs coming.)

When I think about all the amazing investors – and the hundreds of mentors – involved in TechStars, I’m deeply humbled to be a part of it.

I find it endlessly entertaining that people say things like “I don’t need to back up my data anymore because it’s in the cloud.” These people have never experienced a cloud failure, accidentally deleted a specific contact record, or authenticated an app that messed up their account. They will. And it will be painful.

I became a believer in backing up my data when I was 17 years old and had my first data calamity. I wrote about the story on my post What Should You Do When Your Web Service Blows Up. I’ve been involved in a few other data tragedies over the past 28 years which always reinforce (sometimes dramatically) the importance of backups.

We recently invested in a company called Spanning Cloud Apps. If you are a Google Apps user, this is a must use application. Go take a look at Spanning Backup for Google Apps – your first three seats are free. It currently does automatic backup of your Google contacts, calendars, and docs at an item level allowing you to selectively restore any data that accidentally gets deleted or lost. I’ve been using it for a while (well before we invested) and it works great.

I’ve known the founder and CEO, Charlie Wood, for six years or so. Charlie was an early exec at NewsGator but left to pursue his own startup. I came close to funding another company of his in the 2005 time frame but that never came together. I’m delighted to be in business with him again.

Don’t be a knucklehead. Back up your data.

Today we announced that Foundry Group took a bite out of Cheezburger as we led a $30m financing of the company that started out by bringing you cute cate pictures.

Ever since I met Ben Huh 18 months ago via an introduction from Micah Baldwin (see Micah – I do take you seriously – some of the time) I’ve had a major entrepreneur-crush (sort of like a man-crush, but, well, you get the idea) on Ben. C’mon – the guy wears a cheeseburger on his head – how can you not love him.

After meeting Ben, I decided to try out the site. My first LOL was my wife Amy’s car on fire – feel free to click on it and go vote it up.

We’ve made this investment as part of our “Distribution Theme” which includes Zynga, Topspin, and StockTwits. I realize that I haven’t written about Distribution on the Foundry Group blog – guess I’ll go do it after I finish this post. Or maybe I’ll just surf around on some of the 50 Cheezburger Network sites.

I’m back – that was a not so short sojourn to My Food Looks Funny, I Has A Hotdog, FAIL Blog, and Very Demotivational.

Our co-investors are Madrona, Avalon Ventures, and SoftBank Capital. Ben and his team have built an awesome company. I’m really psyched to be a part of it to help it grow to the next level.

Standing Cloud, which makes it easy to deploy and run apps in the cloud, recently closed a $3m financing led by Rich Levandov at Avalon Ventures. Rich and I have known each other and worked together since the mid-1990’s and more recently have invested together in NewsGator and Zynga.

Rich has spend a lot of time in the clouds lately, including his investment in Cloudkick which was acquired yesterday by Rackspace. He got excited about Standing Cloud and their mission to “reimagine hosting” in the context of cloud computing. Shared hosting was a great idea back in 1999 but most users of Web apps today require more control over upgrades, better access to backups, ability to move applications across cloud providers, and extremely high reliability. In addition, deploying apps on most cloud providers continues to be unnecessarily complicated.

There are a huge number of solution providers out in the world who are specialists in any of the more than 70 open-source apps that Standing Cloud supports. For them, Standing Cloud is a simple way to deploy multiple instances of a single app across all of their clients, retain a high degree of flexibility and control over the apps, and not ever have to worry about hosting. These are folks who are helping businesses launch and maintain not only websites but the software they use to run and manage their business.

This week, Standing Cloud launched the Standing Cloud Partner Program for these customers. Becoming a partner includes free hosting for one instance of a single application for one year, volume pricing, and a listing of their services in the Standing Cloud Application Network, launched last week, which is gearing up to be the go-to place for end users and solution providers around Web apps. The program is designed to help grow the business of service providers who customize, support, and deploy online applications, ranging from CMS systems like Drupal, WordPress and Plone, CRM systems like vTiger and SugarCRM, and other business tools like Status.Net, and OpenVBX.

If you’re a solution provider looking for a better way to manage apps for your clients, you can sign up at Standing Cloud. And if you want to see how easy it is to set up any of over 70 open source apps in under five minutes, just select an app and click on “Use It Now.”

This summer I made two new friends who completely blew my mind – Ian Bernstein and Adam Wilson. I met them through TechStars – they were founders of Orbotix, one of the 11 teams to go through this TechStars Boulder this summer. Today, Foundry Group announced that it has led an investment in Orbotix.

I’m always on the lookout for what I consider to be genius level software engineering talent. As an MIT graduate, I’ve been around plenty of it, but I also know that it shows up in unexpected places. A few weeks into TechStars, I realized that not only was I hanging out with genius level software talent but that Ian and Adam thought about hardware and the combination of hardware and software in unique ways. For example, take a look at a robotic ball controlled by a smart phone.

As part of my involvement in TechStars, I choose one or two companies from each program to mentor. We believe the magic of TechStars is the mentorship and while I tried to work with all the companies in the first two Boulder programs, given that there are now over 40 companies a year going through TechStars (10 each in Boulder, Boston, Seattle, and New York), I realized I needed to act like every other mentor and focus at most on two companies per program.

While Foundry Group has investment in two other TechStars companies (both from the TechStars Boulder 2009 program – Next Big Sound and SendGrid) this is the first company that I’ve mentored that we’ve invested in. One of my goals with my mentorship is to work with companies that are both within our themes and outside of our themes – this keeps my thinking fresh in other areas. So, I set the expectation early with the companies that I mentor that it’s unlikely we will invest. For example, the company in the TechStars Seattle program that I’m currently mentoring is absolutely killing it, but it’s far outside any of our themes. But, I’m learning a lot and they are also.

In the case of Orbotix, I knew they’d be within our human computer interaction theme, but when I started working with Adam and Ian, I didn’t realize how profound what they were doing was. Fortunately, by mid-summer I did, and began encouraging one of their other mentors, Paul Berberian, to engage more deeply with them. Paul, Adam, and Ian quickly started talking about teaming up and used the last four weeks of the program to “pretend” they were partners. By the end of the program they decided to join forces with Paul becoming CEO of Orbotix.

While this investment has resulted in endless teenage humor for my inner 14 year old, it is also another step in my personal strategy of making sure that if the robots actually do take over some time in the future, I’ve helped create some of their software.