I recently met Renata George through a referral from Katie Rae (MIT Engine CEO, previously Techstars Boston MD). Renata told me about a book she was working on called Women Who Venture and asked me if I’d write the foreword.

I was honored to be asked to do this. The foreword I wrote follows. The book is out and available now in hardcover and on the Kindle.

As an avid writer and reader, I feel that a book is a unique medium that serves a different purpose than the other written media that we consume regularly. A book can display a variety of perspectives at once, providing enough details on the subjects it explores, while giving us space to contemplate.

When Renata George told me she was going to write a book about Women Who Venture, featuring around a hundred female investors of different generations, I immediately said I’d be supportive. Renata told me that she wanted to do in-depth individual interviews, to both learn and explain the true state of affairs in the venture capital, while celebrating women who best reflect this industry.

The existing bias in the venture capital industry is multidimensional and implicates career challenges not only for women, but also for other underrepresented groups. Many of the investors interviewed for this book, offer advice and solutions to address this issue. Their ideas are bold, opinions are candid, and the narrative sometimes goes against what we are used to reading in popular media.

Having unconventional perspectives to consider is helpful in understanding what true diversity looks like. By being exposed to it, we can identify particular actions that each of us, male or female, can take to generate positive change. It’s the critical mass of all the tiny changes that we can each make daily, that will eventually change the perception, and reality, of diversity in venture capital.

This book is an essential read for aspiring female venture investors who want to be inspired by the life stories of women who made it all the way to the top in venture capital. It is also a valuable resource for male investors interested in increasing diversity. Institutional investors can benefit from learning more about their investees, as well as find new general partners to consider investing in. Finally, entrepreneurs can benefit from the book by learning how the investors featured in it make investment decisions.

Fixing the diversity problem in venture capital will take a long time and require a continuous and steady pace of activities and changes. With Women Who Venture, Renata is helping us all along that journey.

I watched HBO’s Chernobyl the past few nights. I finished it last night, took a deep breath, and said out loud to myself, “that was spectacular.”

One of the final quotes that stuck with me is the title of this post. The full quote is “Every lie we tell incurs a debt to the truth. Sooner or later that debt is paid.”

Read it again. “Every lie we tell incurs a debt to the truth. Sooner or later that debt is paid.” Pause and ponder it. Think about our current world. Let the line linger a bit in your mind.

Now, watch the following ten-minute video for the comparison of Chernobyl to real historical footage. It’s incredibly powerful to watch this after you’ve watched Chernobyl, but might be even more powerful to watch it prior to watching the miniseries, which some are calling a docudrama. While some struggle with the dynamics of a docudrama and others view the techniques of Hollywood as similar to Soviet propaganda, the video below explains things well.

I was an undergraduate at MIT when Chernobyl happened. I remember reading the newspaper headlines from the Boston Globe on a daily basis (something I did most days in college at breakfast.) I didn’t have a TV and rarely went to the TV room in the basement of our fraternity to watch TV, partly because I didn’t really like TV and partly because I didn’t like the mess and smell of the TV room.

I remember being terrified almost every day as the news unfolded. The potential for nuclear war with Russia was a central theme for me growing up, especially during the Reagan years (1981 – 1989) as I went from teenager to young adult. Near the end of this period, Chernobyl was a different kind of terror – that of what was perceived by me, as an American, as a country (USSR) that had no control over planet destroying technology and was both unwilling to be clear about the reality of the situation as well as ask for help.

Today’s dead cities around Chernobyl could have been our entire planet. The map of what is known as the Chernobyl Exclusion Zone is striking.

While some may refer to this as a small part of our planet, it’s a dead part of our planet. Uninhabitable by humans. Sure, there may be uses for this territory, like power generating solar farms, which may serve as a backward-looking justification for how this part of our planet ends up being used. And it’s fascinatingly become a refuge for wildlife 33 years later.

While articles explain in detail Why HBO’s “Chernobyl” Gets Nuclear So Wrong, I think this line of thinking misses the idea that if a few heroic figures hadn’t made the right decisions, stayed after the problem, knowing that they were likely going to die from their own exposure to radiation, while also compelling many others to end up being exposed to extreme radiation in the crisis, containment, and cleanup effort, we might not have a planet. There’s a key moment in Chernobyl (I think in Episode 4), where it’s clear that there is now an unsolvable problem unless thousands of people are mobilized to do a set of time-sensitive and highly dangerous maneuvers to prevent a total meltdown and subsequent explosion of the other three nuclear plants in the facility. The outcome of that could have possibly been the end of our planet, civilization, and human life.

While that didn’t happen, it’s a reminder of the human ability to both create and destroy on a massive scale. It’s then presented against the backdrop of the quote: “Every lie we tell incurs a debt to the truth. Sooner or later that debt is paid.”

We live in a world of endless lies. It’s not just propaganda and misinformation designed to obfuscate and distract. It’s not just things being labels “fake news” whether they are or aren’t. It’s not just in government and politics, but in business, science, philosophy, relationships, and every other aspect of life. It’s just part of what humans do.

Everyone lies, whether it’s deliberate falsehoods, obfuscation, errors of omission, misdirection, denial, or a long list of other reasons or explanations of why people lie. The person who says, “I’ve never lied” is lying, even if they are a fair witness.

“Every lie we tell incurs a debt to the truth. Sooner or later that debt is paid.”

The next time you are about to lie, or participate in a lie, consider whether you are willing to pay the debt from the lie in the future.

Jasper Nathaniel recently wrote a long, detailed post titled When Your Startup Fails. It may be the most vulnerable and honest post I’ve read on failure, certainly in a while.

I spent the day yesterday in Grand Junction at Techstars Startup Week West Slope. After a full day of meetings, events, and talks, I ended up at dinner with a half-dozen CEOs of startups in the area (Grand Junction, Carbondale, Eagle, and Telluride.) I was pretty wiped out from the day and general bail out of dinners between 7:30pm and 8:00pm but we ended up going extremely deep on a bunch of personal and emotional stuff so when I got back to my hotel around 10:00pm I was pleasantly surprised with the tenor of the evening.

While there is endless writing about what to do to build your business, how awesome things are going, and why startups are so magnificent, I experience over and over and over again the intense personal struggle for founders and leaders around creating a business where nothing previously existed.

I wish more entrepreneurs would write extensively about their failure experiences in detail.

David Cohen and I just released Episode 4 of our Give First podcast.

We interviewed Mary Grove on the origins of Google for Startups & Startup Weekend among other things. Mary has been a long time friend and supporter of Techstars and is currently a partner at Rise of the Rest Seed Fund, the co-founder of Silicon North Stars, and on the Advisory Board for the Techstars Foundation.

David and I are starting to get better at the podcast thing. It’s a new medium for both of us so we are learning and iterating quickly on what makes a good podcast interview. Any feedback – good and bad – is welcome.

One of my guilty pleasures is reading biographies about financiers and their companies. On Saturday, I gobbled down King of Capital, which is the story of Steve Schwarzman and Blackstone from inception through 2011.

While I’ve never met Schwarzman, I’ve had a handful of experiences with Blackstone, mostly with the Blackstone Foundation and the head of it, Amy Stursberg. The two most notable are the Blackstone Entrepreneurs Network Colorado and the Blackstone LaunchPad powered by Techstars. Both have been great and impactful organizations and Amy has been a delight to work with.

King of Capital was a really useful book to read on a number of levels. One thing it reminded me of was to read histories of contemporary organizations that were written in the past. While 2011 is only eight years ago, it’s a lifetime in the world of finance, private equity, venture capital, and business. And, the history, stretching back to the 1970s is literally a lifetime (at least for me, who was born in 1965.)

Numerous quotes stood out, but I’m highlighting a few that I thought were spectacular for various reasons. The first is from David Rubenstein (Carlyle Group co-founder – one of Blackstone’s competitors) in 2006.

“Inevitably when people look back at this period, they will say this is the golden age for private equity because money is being made very readily,” Carlyle’s cofounder David Rubenstein told an audience at the beginning of 2006. It was indeed private equity’s moment. That year private equity firms initiated one of every five mergers globally and even more, 29 percent, in the United States. Blackstone’s partners, though, had decidedly mixed feelings about the bonanza. They began to worry that the market was overheating.

2006 was still the pits for venture capital, although a number of legendary companies (LinkedIn, Twitter, Facebook) were in their early phases of getting started. If you were a seed or early stage investor during this time (+/- two years) your returns over the next decade would be epic. However, existing venture investors were massively withdrawn and LPs were piling money into PE firms, not VC firms. And, as we all know, the future for PE and the global economy was about to get really scary.

By early 2007, “we told our [investors] that, notwithstanding the fact that everyone else thinks it’s a fantastic time, the economy is rocking, there are no problems, we’re pulling back,” says James. “We’re not going to be investing, we’re going to be lowering the prices, we’re going to be changing the kinds of companies that we’re going to buy, because when everything feels good and you can’t see any problems, historically you’ve been near a peak.”

That’s a quote from Tony James, who was the #2 at Blackstone for a number of years. I’ve had one meeting with him and he was incredibly impressive.

“It’s not that you see problems coming. You never see problems coming at that point, or no one would be giving you ten times leverage,” James says with hindsight. “There are no clouds on the horizon. What you see is too much exuberance, too much confidence, people taking risks that in the last 145 years wouldn’t have made sense. What you say is, this feels like a bubble.”

And then, a year later, the global finance crisis was in full bloom. Two years later (2009) there were predictions that all of capitalism would fail, every financial institution would be nationalized, and life as we know it would be over.

That obviously didn’t happen. But it was a rough period for a number of years, in which VC and PE swapped places for a while (VC became trendy), but are both now synchronized again in being extremely successful asset classes, while everything seems great and there are no clouds on the horizon.

Hmmm …

My dad had his 60-year reunion at Columbia this weekend. He looks great.

This morning, I did a talk with Om Malik at the Startup Iceland 2019 conference. Om was in a hotel room somewhere and I was in my office in Boulder. We used Zoom, took about 30 minutes of our lives, and had fun riffing off each other. I hope it was useful for the audience, as doing talks this way is so much easier for me than flying halfway around the world, which is something I simply don’t want to do anymore in my life now that I’m 53. But, I’ll happily do a video talk anytime.

Bala Kamallakharan, who is the founder of Startup Iceland, asked a question of us at the end about the future. I went on a rant that is an evolution of my “machines have already taken over” rant from a decade ago.

I used to say that the machines have already taken over. My view is that they are extremely clever and very patient. Rather than self-actualizing, they let us enter all of humankind’s information into them. They are collecting the data, letting us improve their software, and allowing us to connect them all together. At some point, they’ll reach their moment in time, which some futurists call the singularity, where they’ll make the collective global presence known.

While this is still going on, I think there’s a shift that occurred a few years ago. Some humans, and some machines, realized that an augmented human might be a better bridge to this future. As a result, some humans and some machines are working on this. At the same time, they are encouraging, in Om’s world, our current reality to catch up with science fiction. One big vector here is expanding away from earth, both physically and computationally. If you’ve read either Seveneves or Permutation City, then you have a good understanding of this. If not, go read them both.

Regardless. I think the next 30 years are going to be the most interesting in human history to date. And, I think they are going to be very different than anything we currently anticipate. There’s no question in my mind that governments, our current laws (and legal infrastructure), and societal norms are not going to be able to constraint, or keep up with, the change that is coming.

I have no idea what things look like, or how they will work in 2050. However, I anticipate they things will look, and work very, very different than today. And, if I’m still around, I’ll have celebrated my 63-year reunion at MIT.

I was at a board meeting last week that introduced something new into the mix that I thought was brilliant.

At the beginning of each section of the board meeting, there was one slide that was titled: “What Are We Trying To Get Out of This Section.” Before we started into a section, whoever was leading it walked everybody in the room specifically through what she was expecting to get out of the section.

I think we did this five times over a 3.5 hour board meeting. The first time it felt a little pedantic, but by the last time it was clearly magical. Each “What Are We Trying To Get Out of This Section” was different. Sometimes it was a decision. Other times it was feedback. Once it was a set of introductions.

You could feel the people in the room get recalibrated whenever this slide came up. The previous section had come to an end. The new section hadn’t yet started. Take a deep breath. Erase all the noise in your brain. Pay attention again, especially if your mind has drifted because of the bloviating of the Boulder-based long-haired board member.

I’d never seen this particular tactic before. I hope to see it again.

I read Ben Horowitz’s The Hard Thing About Hard Things last weekend. This is the third time I’ve read it. It gets better each time. If you are a CEO and you haven’t read it, buy it right now and read it next weekend.

There are endless gems in the book, many of them from Ben’s own experience. My favorite of all time, that stays with me through all the work I do, is his distinction between “peace time” and “war time.”

I think the first time he wrote about this was in his post in 2011 titled Peacetime CEO/Wartime CEO. There has been plenty of commentary on the web about it (see The Myth of the Wartime and Peacetime CEO, which really only says a CEO has to be effective in both wartime and peacetime to be successful.)

Ben has an incredible rant in the post that starts off with:

Peacetime CEO knows that proper protocol leads to winning. Wartime CEO violates protocol in order to win.

The rant is worth reading every single word, but I want to highlight and comment on a few of my favorites.

The first one is:

Peacetime CEO always has a contingency plan. Wartime CEO knows that sometimes you gotta roll a hard six.

BSG fans know about rolling a hard six even though the definition is contested by pilots who think non-pilots confuse planes with dice. In wartime, the odds are often very against you. Sometimes you just have to get lucky.

Another one that I love is:

Peacetime CEO strives for broad based buy in. Wartime CEO neither indulges consensus-building nor tolerates disagreements.

Things during wartime are intense. Decisions have to be made quickly. Many will be wrong, need to be overturned, and new decisions have to be made. Sitting around arguing about what to do simply doesn’t work. Get all the ideas out on the table, but then choose. And then execute like crazy.

Finally:

Peacetime CEO sets big, hairy audacious goals. Wartime CEO is too busy fighting the enemy to read management books written by consultants who have never managed a fruit stand.

Your big hairy audacious goal in wartime is not to die.

As an investor, I’m involved in some companies operating in peacetime and others in wartime. There’s a lot of emotional dissonance during the day as I go back and forth between them. I’ve learned how to be calm in both modes and deal with my emotions outside the context of interacting with CEOs, founders, and leaders. But, Ben’s metaphor of peacetime vs. wartime has been so incredibly helpful to me as an investor in identifying what mode I’m in that I should probably get him some sort of a gift as a thank you.

In February 2017 I met Shawn Frayne, one of the founders of Looking Glass Factory, a Brooklyn-based company with ambitions to make holographic interfaces a reality. Their team was scrappy and had sold an impressive variety of volumetric display kits to fuel their R&D efforts, and since our human-computer interface investment theme is one of my favorites, we led their Series A round.

Last summer they launched their flagship product, a dev kit called the Looking Glass. It was the first desktop holographic display to come to market for, well, extreme nerds (like yours truly) that have been hoping for holographic displays their/our whole lives.

The Looking Glass dev kits and the adjoining Unity and three.js SDKs sparked a wave of holographic app creation over the past few months, with thousands of hologram hackers creating new and wonderfully weird apps in their Looking Glasses every day. Looking Glass clubs are even springing up, like this one that meets in Tokyo with a few hundred members and growing.

But these systems are strictly dev kits, meaning they require the user to have a powerful computer to connect to and run the holographic display. I have several Looking Glasses of my own and I love them, but most of the time they sit idle because they can’t run standalone. The multitude of holographic apps being created by developers around the world, like holographic CT scan viewers and interactive software robots and volumetric video players for the Looking Glass, haven’t really been deployable outside of a highly technical crowd that already owns powerful computers.

That changes today with the launch of the Looking Glass Pro, an all-in-one holographic workstation. The Looking Glass Pro is a turnkey holographic solution for any enterprise that needs to display genuine 3D content to groups of people without subjecting them to the indignity of donning a fleet of VR headsets.

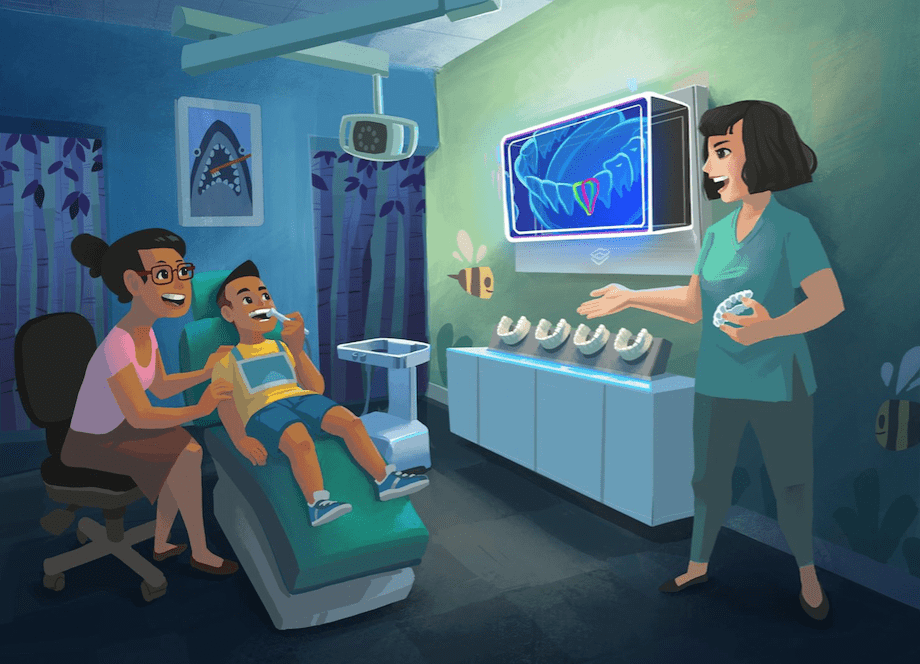

Some first use cases are showing up in fields like orthodontics, where holographic renderings of dental CT-scans for surgeons (and soon for patients) are fast becoming a reality.

In situations where agencies are generating things like volumetric music videos and holographic ads (like in the case of Intel Studio’s production Runnin’, generated by Reggie Watts and written and directed By Kiira Benzing), being shown at the Augmented World Expo this week in a Looking Glass Pro).

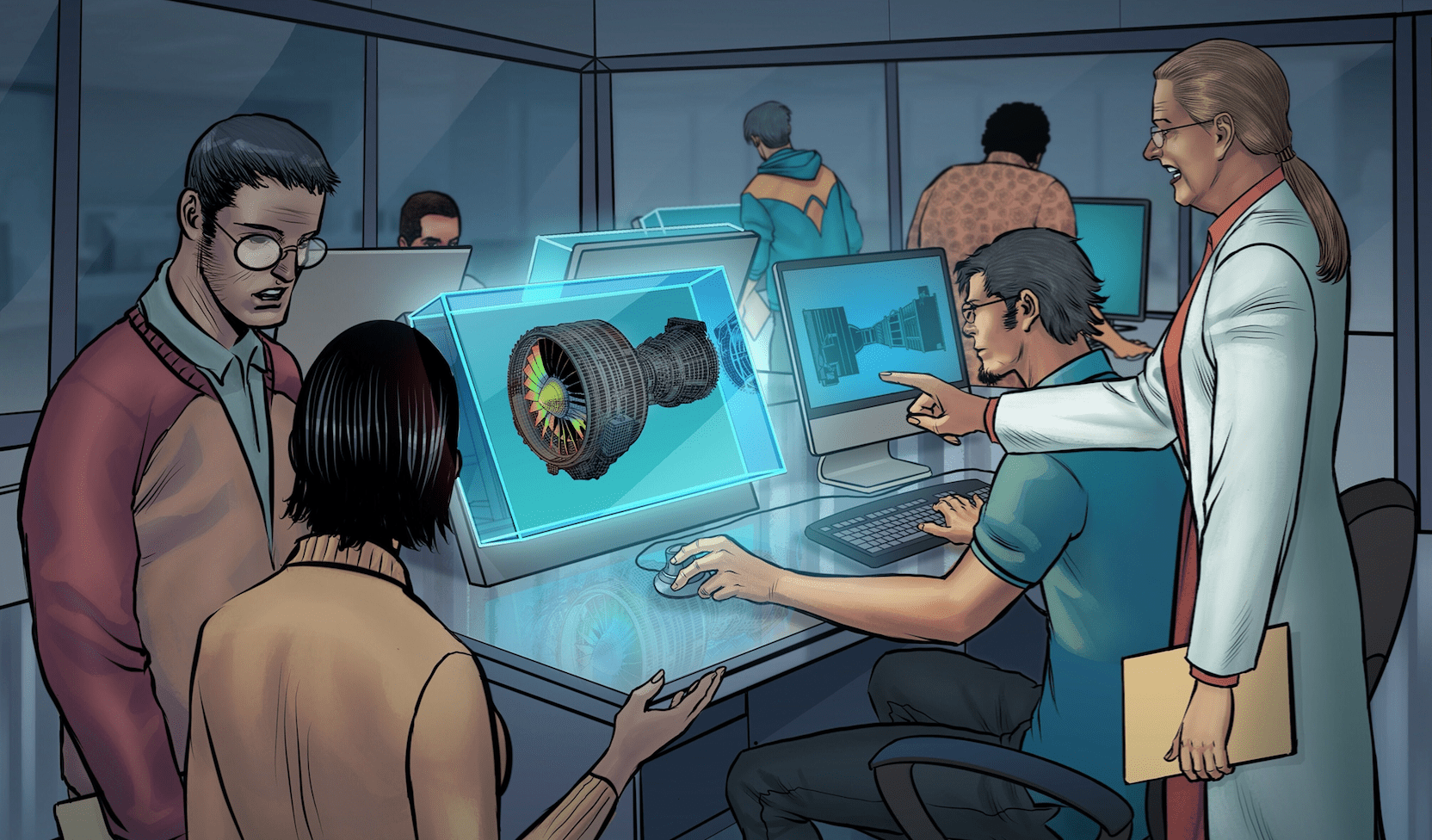

And in scenarios where groups of engineers need to review three-dimensional simulations of phenomenon like the mechanical stresses in to-be-printed parts and complex biological systems in the Looking Glass Pro as if they were viewing the real thing.

The Looking Glass Pro comes with a lot of built-in functionality, including a powerful embedded computer, a direct touchscreen on the holographic display for interacting with the 3D content, and even a flip-out 2D touchscreen for things like text entry and extended UI. Most importantly, the Pro comes with a commercial license to the Holographic Software Suite, a collection of the Looking Glass SDKs for Unity, three.js, and the newly announced Looking Glass Unreal Engine SDK, meaning developers in the enterprise can make apps for the Pro and deploy them fully-standalone for commercial applications for the first time.

This story has been told before, where a new computing platform makes the phase change from a dev kit for a group of technology enthusiasts into something that businesses can use. Think back to the Apple I’s transformation into the Apple ][ series, the evolution (several times over) of 3D printers, or even AR headsets if what Hololens 2 and just-announced Google Glass 2 are doing is any indication.

The launch of the Looking Glass Pro is a sign that that time has come for holographic interfaces.

If you’re an enterprise looking to get into the hologram game, get one of the first batch of Looking Glass Pros today before they sell out.