My running is going well so I’ve decided to do the Knoxville Marathon on 3/31/19.

I’m putting a running team together for this, so if you are interested in being part of it, the only requirement is that you commit to doing the Knoxville Marathon. If you are interested, email me.

2018 was a tough running year for me. I was injured in the spring (calf injury) and then again in the summer through the fall (bone bruise). I’ve only managed 290 miles for the year (I’ll break 300, but that’s less than 30% of my norm for a year.)

However, the last four weeks of running have been solid:

- miles / week: 11.5, 11.5, 12.4, 17.6

- TSS / week 147, 154, 203 478

Distance is improving and pace is improving.

I love running at the time of the year, especially when it’s 50 degrees and sunny in Boulder.

In the world of entrepreneurship, there are endless things to do. Tasks, to do lists, new initiatives, new projects, and P1s. Leaders spend a lot of time planning, especially in the context of “we have to grow more, do more, and get bigger.”

Lately, I’ve been suggesting to a few of the CEOs who I work with to make a “2019 Won’t Do List.” While this is a high-level list of things not to do, it can be on multiple dimensions.

I like to start with things that often are optional, but consume a lot of time and energy. Examples would be “an acquisition” or “a financing” or “an IPO.” Let’s take “acquisition” as an example. Assume you are a fast growing company with plenty of financial resources. Maybe you’ve made some acquisitions in the past. But, you haven’t thought about it specifically, so it’s a reactive or opportunistic move. It’s very freeing to decide “this year we aren’t making any acquisitions and we aren’t going to be distracted by the motion around an acquisition.” The nice thing about being a CEO, especially of a company in a strong position, is that you can change your mind. But by declaring what you won’t do up front for some time, it makes the decision one where you have to actively change your mind about what you won’t do.

Then, I like to roll into metrics that create a floor on how the business will operate. For example, “We won’t have a month of negative EBITDA.” Or, “well never have negative cash flow of more than $500,000.” Or, we won’t hire anyone new, other than replacing attrition, until after we have revenue of $X / person.” These are different than what your goals are, where the goals look like “We are going to grow 10% month over month” or “We will adhere to the rule of 40 for a healthy SaaS company.”

Then, I like to end by pushing the CEO to define personal Won’t Dos. These can be behavioral or functional. Most people are comfortable with the functional ones, but struggle to identify the behavioral ones. I like the struggle around this – it almost always generates fascinating conversations that are highly personal.

An example of something from my Won’t Do list is “take on another book project.” I have several that I’m working on and I’m happy about them, but once I’m finished with them, I’m not going to do any more non-fiction for a while. I have a desire to write some near-term science fiction and see if I’m any good at it. Since I want to finish the projects I have and know that I have poor impulse control around says “sure – I’ll work on that book project,” by putting this on my Won’t Do list for 2019, I say no to everything.

A personal example on my Won’t Do list is “buy another big thing other than art” (e.g., house, car). I’ve got enough. Amy and I talked about this around my birthday (she was looking into getting me a new car) and I didn’t want one. I suggested that we buy a half dozen Subarus and park them in front of my friend Dave’s house (Dave hates Subarus) and call them an “art installation” instead. As I thought through this, I realized I don’t want something new like this for a while. In contrast, I exempted art because when I thought about it, I wanted to buy some additional art this year (especially sculpture.)

What’s on your Won’t Do list for 2019?

Inspired by our friends at Techstars and their Techstars Holiday Guide, we thought it would be fun to highlight some of our direct and partner fund portfolio companies this holiday season. We think everything listed below is awesome, so we’ve tried to keep the hyperbole out of the descriptions so you can quickly scan for anything you are interested in.

Apparel, Lifestyle, and Sports

- Betabrand – Business casual clothing

- Havenly – Online interior design

- Inkbox – Temporary tattoos

- Primary – Kids clothing

- The Pros Closet – Pre-owned bicycles and components

- Wires – Handcrafted eyeglasses

Education

- Bluprint – Online courses from world-class experts

- littleBits – Electronic building blocks

- Modular Robotics – Robot building blocks

- Osmo – Hands-on game system

- Sphero – Educational robots

Health, Fitness, Pets, and Food

- Fitbit – Health and fitness trackers

- Halo Neuroscience – Neurostimulation training headset

- June – Convection oven, air fryer, dehydrator, slow cooker, broiler, and toaster

- Molekule – Air purifier

- Nima – Portable gluten and peanut testers

- Peloton – Exercise bike and treadmill

- Rover – Dog boarding, walking, house sitting, and daycare

3D Stuff

- Formlabs – 3D SLA (stereolithography) printer

- Glowforge – 3D laser printer (laser cutter)

- Looking Glass – 3D holographic display

- Occipital – 3D scanning and mixed reality

Toys and Games

- Harmonix – Music video games (Rock Band and DropMix)

- OpenROV – Underwater robot

- Roli – Musical instruments

- Two Bit Circus – Immersive entertainment experience in LA

Smart Home/Office

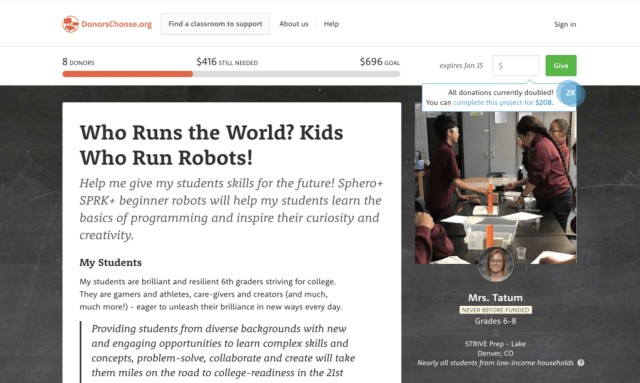

Amy and I decided to match all of the funding for first-time projects in Colorado on DonorsChoosee.org. We are doing this through a gift from the Anchor Point Foundation and will be running it through the end of 2018. We believe deeply in the value of education and particularly like the DonorsChoose.org model of teacher-initiated projects.

There are currently 108 projects that fit this profile. We launched yesterday and nine have already been fully funded (and 330 students have been helped.) The criteria for our match is that these are projects put up by new teachers on the DonorsChoose.org platform.

Our hope is that two things will happen before the end of the year.

First, if you want to support a teacher and students in Colorado, go make a contribution of any amount on DonorsChoose.org from this link and we’ll automatically match it. Or, you can also click this link if you want to do a search on the active projects that Anchor Point Foundation is matching. You’ll notice a mention of the Anchor Point Foundation next to the projects we match – it’ll look like the following.

Clicking through will show a page like the following where you actually make the contribution.

Second, we hope any teacher in Colorado who has never had a fully funded project on DonorsChoose.org before, submits a project before the end of the year. We’ll match those projects as well, so getting more online is an awesome thing.

We believe DonorsChoose.org is an outstanding platform for getting additional funding into classrooms. Please help us support education in Colorado.

I just spent the last 30 minutes writing a blog post around a simple phrase that I like. I built out my thought process around it, used a handful of examples, and then filled in some additional ideas. I was proofreading it when I decided to go try to find the original source of the phrase.

The first page of Google’s results surprised me. There was nothing on the phrase I liked, but there was a wall of vitriol and controversy around a phrase that is close but had a few different words in it. When I read a few of the articles, I quickly was able to tie it back to something someone at Breitbart said. And then I vaguely remembered the controversy around the phrase.

I realized that it would be easy to misinterpret the phrase I liked as the phrase that had all the controversy around it. I said them both out loud and slowly a few times, and concluded that the post needed a lot more work if I were to publish it. Basically, if someone read what I wrote and thought about it, they’d likely separate what I was saying from the other quote that I found objectionable. Or, if they didn’t know about the other quote, they’d just be tracking what I said.

But, if they knew the other quote, the controversy, and they felt strongly one way or another about it, then what I wrote would likely be lost is the soup of the previous controversy.

Normally, when I write, I just hit publish after I’m done. I learn a lot from writing and it helps me work out my thoughts and ideas, which is the main reason I do it. I don’t try to get everything right the first time through (if you are a long-time reader of this blog, you’ll notice the iteration of lots of stuff as I refine it with different examples, evolve my thinking, or respond to other challenges and stimulus.)

In this case, I was worried that my thoughts would be judged because of the linkage to the controversy around this other phrase. Given the two phrases, this is deliciously ironic (kind of like capers, which I despise.) So, I hit save draft instead of publishing the post, wrote this post instead, and am now heading out for a run to contemplate what just happened, since I think this may be the first time in about 5,000 posts that I experienced this hesitation to just publish something I wrote.

It’s the second week of December, which is about the time that all of the predictions for 2019 start occurring. Last week’s announcements of the confidential S-1 filing of Lyft, Uber, and Slack helped prime the pump for some of these. By the way, did anyone other than me think it was a strange turn of events that companies are now announcing their confidential S-1 filing?

Fred Wilson’s post Thinking Ahead To 2019 is worth reading. Unlike the endless stream of predictions that are about to come out, it’s an analysis of the spread between the public market and private company valuations. Fred is not predicting anything in particular but makes several useful observations, including the following:

“And yet storm clouds are on the horizon for the capital markets in 2019. Rates have risen significantly in the last eighteen months, pulling capital out of the equity markets and into the fixed income markets. There are some leading indicators that suggest a business slowdown is on the horizon, which would be the first one in the US in a decade. And, of course, the situation in DC is getting dicey and that will weigh on markets as well.”

Last week I was talking to a friend who is a growth investor. He and his firm see most of the bay area growth deals (e.g. the unicorns stampede to their front door). He made an observation that a number of deals he’s now seeing are for flat rounds with companies that need to raise more money to keep going and he’s feeling the slow down of investor interest at this level. This dynamic is reflected in the article Scooter Firm Chases Funding to Staunch Losses about the current Lime and Bird financings.

Any student of history knows that there is a linkage between the push to the public markets, demand dynamics of the public markets, and the availability and attractiveness of capital in the private markets. If you lived through the Internet-bubble between 1999 and 2002 you know this cycle well. And, you know that the companies that survived it were the ones with very strong fundamental businesses (e.g. Google), regardless of whether they were private or public at the time.

At the same time, entire categories collapsed. The web hosting business – lead by Exodus – almost entirely went bankrupt or was restructured. Out of this mess came several long-term companies and a huge number of pennies on the dollar type acquisitions. If you were on the winning side of this, it was incredibly lucrative, because even in a massive collapse there is a huge long-term opportunity. But you had to be thinking about the economics and capital structure of the business, versus just chasing growth with more equity dollars.

I have no interest in predicting anything, including how any specific category or company will perform. I also have no idea what the timing of anything is. I do know that if you are an entrepreneur or investor, you should pay attention to the context but be very focused on building a durable long-term business. And this moment in time is one that feels like you should be aware of how much capital you have, how you are spending it, and when (or if) you will need to raise more.

Remember – it can all go to zero (a post I wrote when Bitcoin was at $12,000.)

I’ve been in San Diego with Amy for a while but we are returning to Boulder in a week. San Diego has been great, but I miss my dogs, my friends, and the Colorado vibe.

When people ask me about the Colorado vibe, I often talk about GiveFirst. Soon there will be a book (by me) on this, but for now there’s an increasing amount of content on the web building up to explain it. This article in the Colorado Sun – How Techstars’ “GiveFirst” mantra became a road map for the startup community in Colorado and beyond – was excellent and had numerous short examples of how GiveFirst works and influences a startup community.

Next up is a fun article by my co-author of Startup Communities Way (my new Startup Communities book – coming up mid-year 2019) Ian Hathaway. A few days ago he cranked out a post titled Colorado is for Founders. I love that phrase and he led off the post with this great tweet from Phil Weiser.

Excited to work with our new Governor and my client to be, @jaredpolis. pic.twitter.com/5jOv1K0gDL

— Phil Weiser (@pweiser) December 5, 2018

He goes on to explain Jared and Phil’s huge accomplishments and impacts around startups and the startup community. The punch line in the post is:

“By many measures, Colorado is the most entrepreneurial state in the country, a fact that I discovered in 2013 when studying high-technology business formation around the United States. I was struck by just how many places across the state had a high proportion of startup activity occurring—a finding that has been extended to looking across other types of high-growth entrepreneurship as well. Something special is happening there, and it has been for many years.”

I’ll end with the Holiday Gift Guide from Techstars. If you want to give someone you know the gift of something from a Techstars company this holiday season, here are the choices all in one place.

Happy Friday Colorado. See you in a week.

I saw an article about George Raveling recently in the Daily Stoic newsletter. Raveling – known as Coach Rav to many, has a pretty remarkable history. And an even better life philosophy that fits very nicely with #GiveFirst.

On his website, he has a page titled 23 Life Choices That Are In Your Control. It’s delightful and follows.

1. Be YOU, not them.

2. Do more, expect less.

3. Be positive, not negative.

4. Be the solution, not the problem.

5. Be a starter, not a stopper.

6. Question more, believe less.

7. Be a somebody, never a nobody.

8. Love more, hate less.

9. Give more, take less.

10. See more, look less.

11. Save more, spend less.

12. Listen more, talk less.

13. Walk more, sit less.

14. Read more, watch less.

15. Build more, destroy less.

16. Praise more, criticize less.

17. Clean more, dirty less.

18. Live more, do not just exist.

19. Be the answer, not the question.

20. Be a lover, not a hater.

21. Be a painkiller, not a pain giver.

22. Think more, react less.

23. Be more uncommon, less common.

If you just skimmed the list, I encourage you to go back and read it again. To slow down and really savor it, read each line out loud and then ponder what you are doing to make that choice on a daily basis.

I’ve watched a pretty remarkable thing unfold in the past year that culminated yesterday in the launch of a new product from Adero. For a one minute overview, watch the video below. For a longer overview, read the Hello from Adero post from Nate Kelly, the CEO.

Adero is shipping now. As a reader of my blog, you can get 20% off a purchase using the code FOUNDRY20. I’ve been using the production product for 30 days and it’s dynamite.

Adero is what has emerged from our investment in TrackR and is a very long story for another blog post. After a very difficult Q4 last year, we reset a number of things on the business, including the leadership team. Nate Kelly, who had been hired as COO, took over as CEO and in February decided to effectively start from scratch with the hardware, software, and long-term product vision.

Nate and the team have – in nine months – designed, built, and shipped an extremely impressive next-generation product. The amount done in that period of time has been mind-blowing to me after having worked with many hardware-related companies. It’s not just the creation of the product, but the quality of the total product – hardware, software, brand promise, and organization to support it – that is impressive.

I’m really excited about the next phase of this company. We’ve had many successes emerge from companies that stalled or had major problems. Every successful company of ours has had at least one near-death experience. The last year has been extremely intense for this company, and I have enormous respect for the effort of every person there.

Help me on the next journey of Adero by becoming a customer and giving me feedback – of any type – to pass on to the team. They are a learning and building machine that is as impressive as any that I’ve gotten the pleasure to work with over the years.